Q&A: Infrastructure Debt Goes Mainstream

Opportunities abound while transactions are getting bigger and—for investors who can transact at scale—better.

Introduction

High inflation, elevated interest rates and bank retrenchment have driven considerable growth for private credit loans among infrastructure borrowers. Meanwhile, investors have readily met this demand, seeking exposure to counter-cyclical assets that offer a hedge against inflation and market volatility—and a way to leverage the megatrends shaping the global economy.

In the following interview, Ian Simes and Eric Wittleder discuss the trends and tailwinds behind private infrastructure debt, which industries and regions have been most active, and their approach to investing in this growing asset class.

Q&A

Q: What is driving increased interest and allocations in private infrastructure debt today?

Ian Simes: Many investors have been focused on allocations that add income, stability and resilience to their portfolios, which are the defining characteristics of infrastructure as an asset class. These are long-lived assets with stable cash flows, since they provide essential services and enjoy high barriers to entry.

Let's say you are an investor considering the private debt space and comparing infrastructure to other sectors. Given where we are today, infrastructure debt uniquely offers very low volatility and significant downside mitigation. Typical corporate direct private lending, on the other hand, tends to be more exposed to inflation and rising interest rates. And private credit generally is facing an upcoming maturity wall that will test that market, whereas infrastructure debt is less exposed to the same maturity risk.

Eric Wittleder: Also, the broader infrastructure asset class has come to the forefront as investors look to leverage the megatrends known as the “Three Ds” in their portfolios: digitalization, decarbonization and deglobalization. But it can be challenging to gain targeted exposure to infrastructure debt in the public market. So, institutional investors have sought private debt opportunities as a means to participate in this infrastructure supercycle.

Infrastructure lending across the board has increased steadily and significantly over the past decade-plus (see Figure 1). And in the private market, we are seeing the deals grow larger, too. In this environment, those few investors who can provide infrastructure finance at scale will have an advantage and be able to pick their spots, to a degree.

Figure 1: Infrastructure Debt Transactions Have Tripled in a Decade

Bil. $

Source: IJ Global Data Transactions – accessed June 2023.

Q: Eric, you mentioned that infrastructure transactions are getting larger. What’s behind that trend?

Wittleder: It’s essentially due to the immense capital required to advance those three Ds (see Figure 2).

For example, it used to be that data center builds would start off with, say, 3 megawatts. Then it became 30 megawatts, and now it's closer to 300 megawatts. And while it used to cost about $50 million to develop a data center, now it's over a billion.

Or, in the renewables space, it used to be impressive to have a development pipeline with 1 gigawatt of capacity, and now it’s common to have 20 gigawatts in the pipeline. The capital needed—and the expertise required—to develop that is significant.

What’s more, many issuers today are focused on execution speed and certainty so that they can hit their targets. Being able to provide them with a full debt solution at scale is a significant advantage in this environment.

Figure 2: Borrowers Are Seeking Financing Solutions Across All Types of Infrastructure

Q: Demand for data—and the infrastructure to support its growth—has surged recently. Where are you seeing opportunities in this space?

Simes: That’s absolutely right. We like to say that data is the world’s fastest growing commodity. Much of the world’s data usage was already migrating to the cloud when artificial intelligence capabilities became widely available and popular. And AI is incredibly computational and power-intensive—a ChatGPT query needs nearly 10 times as much electricity to process as a traditional Google search.1

As cloud computing and AI services/applications have proliferated, this exponential growth in global data consumption is driving massive investment opportunities in storage and transmission assets. The World Economic Forum estimated that 463 billion gigabytes of data—equivalent to about 18 million years of HD streaming on Netflix, or enough data to fill almost 4 billion iPhones—will be created each day globally by 2025. Historically, these investments were funded by the operators, including technology companies and telecoms, but given the increasing demands being placed on their capital for active equipment upgrades (such as data centers and 5G), they are increasingly seeking new funding partners.

For example, there is expected to be over $1.3 trillion of capex needed to build out data center capacity to satisfy demand for cloud computing by 2026. And that doesn’t even include the growth of AI.2

Q: What is driving opportunities in decarbonization, and which spaces are most attractive?

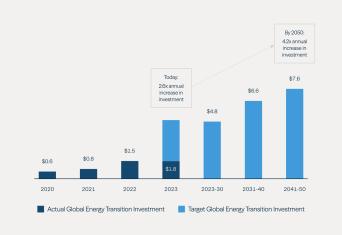

Simes: Renewable power is a big focus for us as companies and governments increasingly seek decarbonization solutions. The tech and transportation industries especially need more and more green electricity. All in all, annual investment in energy transition and transmission needs to more than quadruple by 2050 (see Figure 3).

Private capital can help address the funding gap, as traditional sources of capital have become harder to access. Indeed, we are seeing many opportunities to offer flexible capital solutions to finance M&A, growth and capital expenditure needs, partial realizations, or cost-of-capital optimization.

Figure 3: Annual Investment Must Accelerate to Achieve Net-Zero Objectives

Annual Energy Transition and Grid Investment Current vs. Required (Tril. $)

Source: BloombergNEF, Energy Transition Trends 2024. January 2024, Research conducted by Bloomberg established the targets.

Wittleder: An often-overlooked area of the transition space is “demand side” decarbonization, which is driven by the consumer and cost. As a result, more corporations and communities are looking to meet consumers’ demand and reduce costs by increasing energy efficiency, lowering energy consumption and reducing reliance on fossil fuels.

This has created investment opportunities in residential energy infrastructure, submetering and residential smart metering. For instance, we are investing in platforms in both Europe and North America that provide energy-efficient products and services. These offer consumers significant cost savings to the prevailing alternatives.

Q: Where are infrastructure debt opportunities intersecting with deglobalization, or the third D?

Wittleder: Global supply chain disruptions and recent geopolitical events have led governments and corporations alike to prioritize their supply chain resiliency—particularly for baseload power, critical manufacturing and logistics.

For example, LNG will continue to play a key role in providing global energy security. This means that globally, infrastructure will be needed in critical locations to process, transport and distribute natural gas.

There is also an increasing focus on bringing important manufacturing processes onshore, such as semiconductor factories. Both the U.S. and Europe have announced programs to support the buildout of semiconductor facilities, committing upwards of $100 billion to back the reshoring of this manufacturing from Asia.

Finally, transport infrastructure and logistics networks must also evolve to become more resilient in the face of long-term rising demand. These assets and networks will require significant capital—both to clear up bottlenecks and to add capacity.

Q: What opportunities are you seeing in utilities?

Wittleder: Municipal and state-owned utilities are increasingly looking to privatize or find alternative funding to meet the growing demands on their electricity transmission and distribution systems. It’s crucial to ensure that grids have the built-in flexibility to transmit and distribute energy from renewable sources. Privately owned utilities looking to achieve this same flexibility may also face capital constraints. They are then turning to private capital providers that have the experience to fund growth projects in this sector. Many utilities are also realizing that the efficiency benefits gained from smart metering, energy storage and other solutions will require substantial capital to deploy in the near term.

Simes: Another way that local municipalities can achieve their decarbonization goals is through district energy. These assets provide heating or cooling to multiple buildings from centralized facilities through a common and interlinked distribution system. They generally cost less and are more reliable than boilers or chillers contained within individual buildings. The systems have strong infrastructure characteristics through either their essential and cost-efficient nature, or through the use of long-term, capacity-based contracts with fuel cost pass-through, creating stable revenue streams.

Q: Any other sector opportunities to consider?

Wittleder: While not the same activity level as power and data, opportunities in transport infrastructure continue to arise. Roads, rail, marine and logistics businesses are looking to add capacity to their networks and to meet increased demand while maintaining a high quality of service.

For example, many regional mid-market transportation assets in the U.S. have been family-owned, and over time are being aggregated by institutional investors to enhance synergies across networks. We have financed such rollup opportunities, supporting the institutionalization of that service.

From an investor’s point of view, the long-term value and typical links to inflation mean that such assets tend to withstand periodic traffic fluctuations, provided they have sufficient near-term liquidity.

Simes: We also continue to see opportunities in the midstream sector, where natural gas is proving to be an essential transition fuel to support the growth of intermittent renewable generation as well as enhancing energy security, leading to significant investment requiring private capital solutions. Given our ability to move quickly, we have been able to provide sponsors with our type of financing as they look to accrete returns and reduce their equity tickets.

Q: Could you discuss how you are weighing infrastructure sectors today in the context of portfolio construction?

Simes: We generally have higher weightings on the sectors with greater activity, so today, those are data—including wireless infrastructure, fiber networks and data centers—and renewable power.

Yet, we are very mindful of building a diversified portfolio. For instance, if we zoom out and see a concentration in data, then we’ll drill down and consider things like how much of that is laying fiber-optic cable to homes? How much of that is cell towers serving mobile phones? How much is data centers? We make sure the risks are not correlated.

Wittleder: We can also drill down further in each of the assets. For example, are we concentrated in any one region or offtaker, the party that's paying to use those sites?

By engaging in this deeper analysis, we can both focus on active sectors and make sure our portfolio remains diversified.

Q: Any final thoughts?

Simes: Yes, I think investors should consider the importance of structuring within the infrastructure debt space. Unlike corporate credit, infrastructure deals tend to be much more complex. A toll road is quite different from a wind farm, so we must drill down into each asset and then structure the loan accordingly. This is one reason why infrastructure debt tends to be insulated from the boom-bust cycle of corporate credit.

Wittleder: There's also a significant amount of diligence required when underwriting infrastructure debt. A lender needs to understand how each asset works, how the contracts work, the regulatory environment, the technical and operational aspects, etc. This also limits competition, since not every investment company has the institutional knowledge or technical expertise needed to assess these risks.

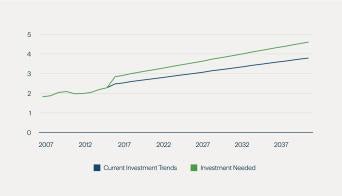

Simes: Yet these complexities are part of what makes infrastructure debt so attractive—when you do it right. And we’re seeing many more opportunities to do so. Estimates of the required infrastructure investment needed globally are massive across both developed and emerging economies. Approximately $94 trillion of cumulative infrastructure investment will be needed through 2040 (see Figure 4).

In other words, we have a lot of work ahead of us—and we look forward to it.

Figure 4: Infrastructure Investment Needs Outstrip Current Trends

Tril. $

Source: Global Infrastructure Outlook

Endnotes:

1. Source: Goldman Sachs

2. Source: Credit Suisse, Dell’Oro

Disclosures

The commentary and information contained in this paper is for educational and informational purposes only and does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments offered or sponsored by Brookfield Corporation, Brookfield Asset Management Ltd. and/or their respective affiliates (together, "Brookfield"), and under no circumstances is this paper to be construed as a prospectus, product disclosure statement or an advertisement. In addition, the information set forth herein does not purport to be complete. Any offer to invest in a private fund sponsored by Brookfield will be made only to qualified investors and only by means of such fund's offering materials, which contain risk disclosures that are important to any investment decision regarding such fund and is subject to the terms and conditions contained therein.

This paper includes statements by certain Brookfield employees that reflect their personal views on various matters, including broad market, industry or sector trends, other general economic or market conditions and forward-looking statements, and should not be construed as the views of Brookfield in general or relied on as a promise or guarantee that the views expressed will prove to be accurate. Nothing contained therein should be deemed to be a prediction or projection of future performance of, or provide an overview of the terms applicable to, any investment, fund or program managed by Brookfield.

Past performance is no guarantee of future results. An investment in any security is speculative and involves significant risks, including loss of the entire investment. Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.