How Should Investors Assess Private Real Estate Credit Opportunities?

Because of the relationship-based nature of private commercial real estate lending and the customized loan characteristics, properly sourcing, underwriting, structuring and monitoring these investments is critical. That’s why we believe it’s important for investors to closely evaluate their potential fund managers with a focus on the following key attributes.

Robust deal-sourcing pipelines

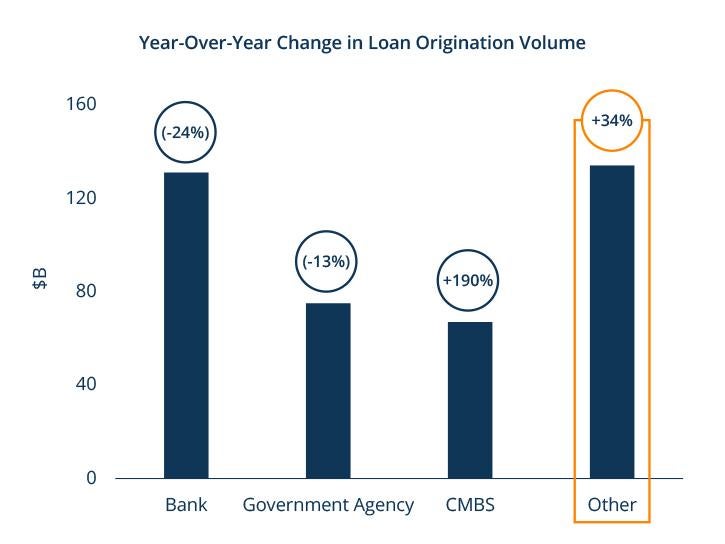

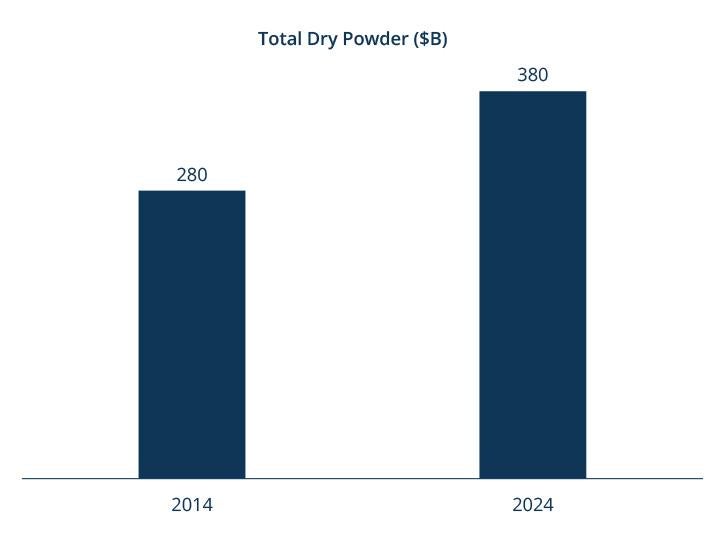

Increased competition for commercial real estate loan opportunities means established firms with large origination platforms and strong deal-sourcing pipelines have a significant advantage over newer, smaller firms with less-robust platforms. They can also benefit from differentiated deal flow and potentially offer investors more access to attractive alternative sectors like student housing, single-family rental, storage and life sciences. Managers should demonstrate consistent access to diverse lending relationships across market cycles.

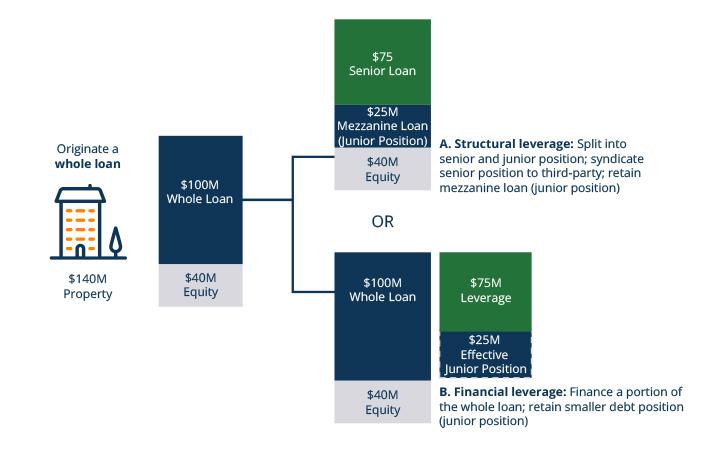

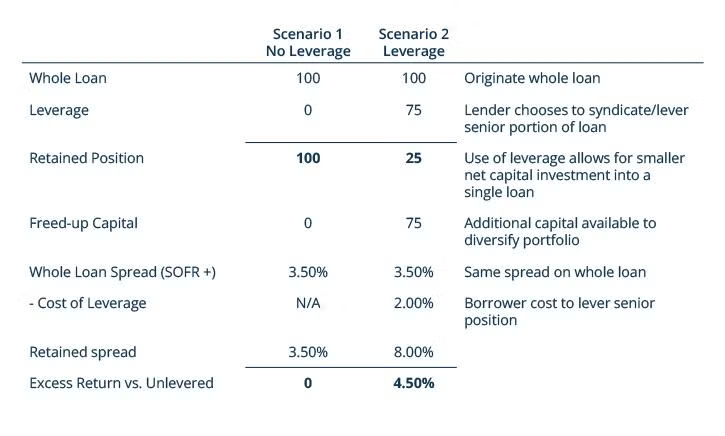

Sufficient leverage management

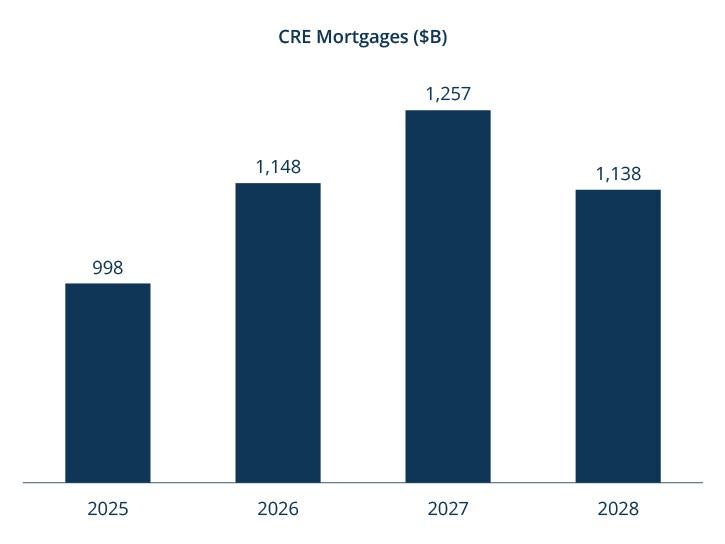

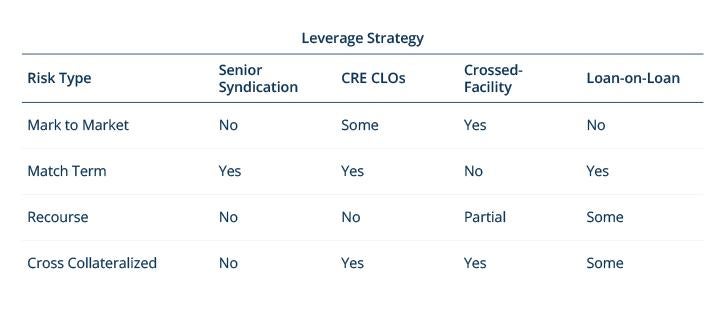

While loan originators may use leverage offered by commercial banks to amplify returns, the term of the leverage facility and that of the loan’s underlying assets are often mismatched. This can create leverage refinancing risk. Leverage providers also may demand quick repayment when asset values fall in a downturn, magnifying liquidity problems. Fund managers with extensive experience in the capital markets are better positioned to mitigate these risks and obtain new financing as needed.

Thorough due diligence

Private commercial real estate lending requires extensive research normally associated with private equity real estate investments. While private real estate lenders must have the proper staff and resources to conduct this research, investing in alternative sectors also requires sector-specific expertise. Lenders who are also owner/operators not only have this expertise, but they are also able to step in to manage the asset if the borrower defaults.

An appropriate investment structure

Commercial real estate lenders without structuring expertise or with narrow investment mandates may lack the flexibility and creativity to adapt to borrowers’ needs, leaving them unable to seize attractive opportunities or design financing structures to maximize risk-adjusted returns. Fund managers should provide the necessary resources to properly address the legal, tax and regulatory concerns that often arise when setting up customized structures.

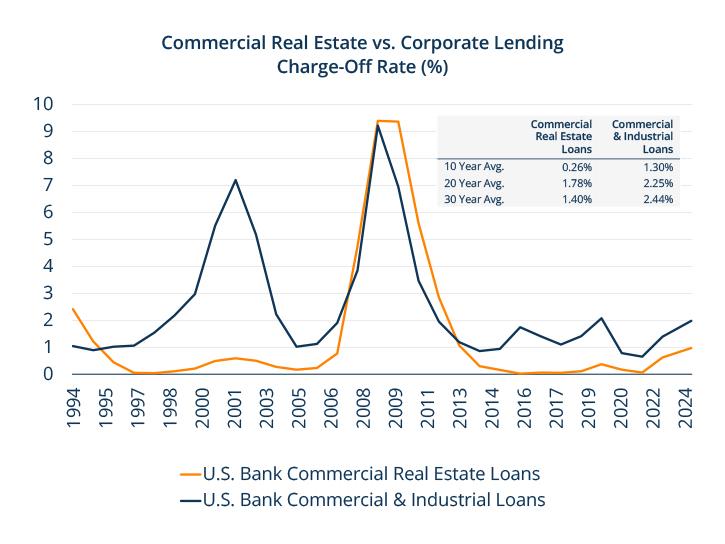

Significant restructuring experience

Commercial real estate lenders with limited experience navigating distressed situations and challenging economic environments may lack the skills needed to identify early signs of borrower distress, help those borrowers regain financial stability or recover maximum value if an investment falters. Successful fund managers should continuously and rigorously monitor their investments to address problems early, and they should have a history of offering effective loan workouts with favorable covenants to mitigate default risk.