Creating Value Through Sustainability Measurement: Brookfield’s Approach

By taking a data-driven approach to decarbonization, we can uncover opportunities among our investments and make informed decisions on which decarbonization pathways they can follow.

Key Takeaways

- As one of the world’s largest decarbonization investors, Brookfield’s operating capabilities, scale, and global reach help accelerate the transition to net zero while delivering lasting value for investors and partner companies.

- Brookfield supports our net zero ambition through the continuous monitoring of greenhouse gas (GHG) emissions data, which is critical for benchmarking performance and tracking progress toward our overall decarbonization goals. Brookfield reports on emissions across over 75% of our Invested AUM.1

- Our Achieving Net Zero Framework helps measure and catalyze decarbonization by setting out a phased approach for assets as they advance from transition plan development to being managed in alignment with net zero pathways. To complement the Achieving Net Zero Framework, Brookfield developed our Decarbonization Decision Tree, which assists portfolio companies in identifying tangible steps to catalyze progress along our Achieving Net Zero Framework and reduce emissions.

- Brookfield also designed and implemented an Impact Measurement and Management (IMM) framework for our Transition Strategy, which includes quantitative, transparent and verifiable impact targets for each of its investment in alignment with the goals of the Paris Agreement and informed by scientific pathways, where applicable.

- Sustainability data supports several value creation or preservation levers for our portfolio companies, including cost savings through operational efficiencies, physical and transition climate-related risk mitigation, reduced cost of capital and product differentiation. By taking a data-driven approach to decarbonization across these frameworks, we can uncover opportunities among our investments.

Driving Decarbonization with Data

At Brookfield, we have recognized the need to integrate sustainability data into our operations to guide our decarbonization efforts and enhance value across our assets.

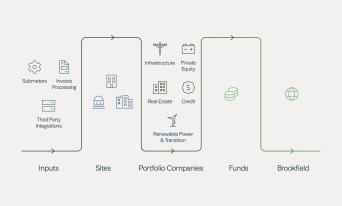

As a signatory to the Net Zero Asset Managers (NZAM) initiative, we set an ambition to achieve net-zero emissions across our Operationally Managed Investments2 by 2050. In 2021, Brookfield established our interim target, setting out our commitment to reduce emissions across $147 billion of our assets under management by 2030 from a 2020 base year.3 Brookfield has since added more assets, increasing our interim target to $263 billion in 2023 (approximately 42% of Operationally Managed Investments).4 We support this effort through the continuous monitoring of GHG emissions data (see Figure 1), which is critical for benchmarking performance and tracking progress toward our overall decarbonization goals.

The key elements of our strategy are the development and implementation of three initiatives: our Achieving Net Zero Framework, Decarbonization Decision Tree, and Impact Measurement and Management Framework (each described below). We observe that access to high-integrity sustainability data across our assets, as well as contextualizing an asset’s decarbonization progress over time, can bolster our business planning, risk management and value creation initiatives. 5

Figure 1: Data Collection Process

Achieving Net Zero Framework

Brookfield’s Achieving Net Zero Framework helps measure and catalyze decarbonization progress by setting out a phased approach for assets as they advance from transition plan development to being managed in alignment with net zero (see Figure 2).

We begin the process by assessing our portfolio companies’ baseline emissions to help inform us of future decarbonization potential. We believe these assessments are critical to supporting business resilience and developing a value-accretive sustainability strategy. In conducting assessments, our focus includes collecting data most relevant to our businesses and implementing processes to advance our assets’ decarbonization progress. For transparency and accountability, Brookfield plots assets along a continuum of stages of decarbonization and seeks to disclose movement of those assets along the continuum over time.

Figure 2: 2023 Achieving Net Zero Framework Plotting

Note: Assets included in this analysis comprise primarily Operationally Managed portfolio companies as of December 31, 2023.

Example: Brookfield’s Transition Strategy

Brookfield’s Transition Strategy (the Strategy) is allocating capital to impact some of the hardest areas to decarbonize through Paris-aligned business plans and long-term investments. It is focused on decarbonizing carbon-intensive sectors and developing clean energy and sustainable solutions to accelerate the global transition. The Strategy has a dual objective: 1) to achieve strong risk-adjusted financial returns and 2) generate a measurable positive decarbonization impact.

After assessing an investment’s alignment with Brookfield Transition Strategy’s impact objectives, quantitative, transparent and verifiable impact targets are identified during due diligence using a credible methodology for the business or asset. This is informed by third-party guidance and scientific pathways, such as the Science Based Targets initiative (SBTi) pathways, where relevant. The Strategy also determines near-term actions and creates a high-level business plan, incorporating the identified targets and an informed view of longer-term activities and resources to achieve them. These are included in the underwriting, and are reviewed by the Brookfield Transition's Investment Committee. Post-acquisition, the Brookfield Transition Investment and Sustainability Teams partner with the portfolio company Management Team to execute on the identified near-term actions and develop detailed business plans to deliver the impact targets and decarbonization. This includes developing an emissions baseline and identifying the levers to support decarbonization along with the determined financial returns across scope 1, 2 and material scope 3 emissions. These levers may comprise activities such as the build out of clean energy solutions, the introduction or development of technologies to support energy efficiencies or decarbonization, carbon capture or storage, fuel switching and/or decommissioning of carbon-intensive assets. Based on the Paris-aligned business plans, Brookfield can plot each of our transition investments along the Achieving Net Zero Framework as: Committed to Aligning; Aligning; Aligned; or Achieving Net Zero.

Decarbonization Decision Tree

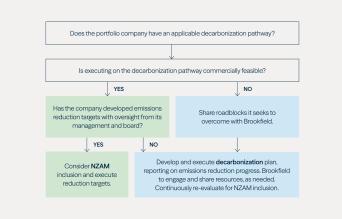

Brookfield developed our Decarbonization Decision Tree to assist portfolio companies in identifying tangible steps to catalyze progress along our Achieving Net Zero Framework and reduce emissions. We use the Decarbonization Decision Tree to identify common roadblocks and assist portfolio companies in driving toward targeted results, thereby increasing Brookfield’s in-scope NZAM assets.

Once an asset’s baseline is determined on the Achieving Net Zero Framework, we use the Decarbonization Decision Tree to guide the portfolio company along a pathway designed to realize its full decarbonization potential (see Figure 3). The emphasis is on the following:

- Measuring emissions

- Selecting the most relevant decarbonization pathways (prioritizing science-based approaches, where commercially feasible)

- Developing emissions reduction targets

- Executing on decarbonization plans

We support management teams in incorporating this guidance into their business planning, emissions forecasts, decarbonization levers and risk assessments.

We recognize that there can’t be a “one size fits all approach” to decarbonization. We are committed to advancing portfolio companies’ decarbonization journeys even if it is not feasible for them to immediately conform to a net-zero aligned pathway. Portfolio companies may be constrained by factors such as a lack of available or commercially viable pathways, lack of available technology, or policy support, among others. Brookfield supports the efforts of all our portfolio companies in feasible emissions reduction as it serves as a value creation or preservation lever. We encourage portfolio companies to maximize their decarbonization potential based on current technologies and insufficient policy supports, continuously reassessing opportunities as these factors evolve.

Figure 3: Decarbonization Decision Tree

Example: Brookfield’s Real Estate Core Office Portfolio

In keeping with the first step of the Decarbonization Decision Tree, Brookfield Real Estate’s Core Office Portfolio selected the draft Science-Based Targets Initiative Buildings Guidance, developed in collaboration with Carbon Risk Real Estate Monitor, as its applicable decarbonization pathway. Brookfield’s engagement, together with the guidance provided by this pathway, enabled the portfolio to set decarbonization plans and to be considered for NZAM inclusion. This portfolio continues to progress towards five- to 10-year emissions reduction targets, including by procuring clean energy. It is plotted along the Achieving Net Zero Framework as Aligning and Aligned.

Impact Measurement and Management (IMM) Framework

To assess the effectiveness of its sustainability initiatives, Brookfield's Transition Strategy (the Strategy) designed and implemented an IMM framework based on Operating Principles for Impact Management. This framework includes quantitative, transparent and verifiable impact targets set for each investment in alignment with the goals of the Paris Agreement and, where applicable, using the relevant sector decarbonization pathways. The IMM is informed by and aligned with industry-leading climate reporting standards and impact frameworks. Through the implementation of its IMM framework, the Strategy seeks to support the progression of private market decarbonization reporting standards.

Impact targets are integrated into each asset’s investment business plan, aiming to align with the goals of the Paris Agreement. Our Transition Strategy conducts regular monitoring of impact targets at the asset, business and board levels. It also produces comprehensive reporting for each investment on progress against impact targets and GHG emissions. The Strategy's transition investments’ emissions data is assured annually by a third party.

As part of the IMM, the Strategy's “4A” Impact criteria are its method for screening the sustainability and decarbonization potential of prospective transition investments in terms of Alignment (investing in global decarbonization impact themes), Additionality (providing meaningful contribution to advance impact), Accountability (measuring targets and outcomes), and Avoidance (mitigating negative environmental and social risks) (see Figure 4).

Example: California Bioenergy (CalBio)

An example of Brookfield's Transition Strategy applying its 4A criteria is its investment in CalBio, a company that uses farm waste to create renewable natural gas, helping to transform waste and minimize methane emissions. In keeping with the Strategy’s IMM framework, CalBio Aligns with its sustainable solutions investment theme, accelerates the deployment of Additional low carbon energy and Avoids sustainability risks identified through appropriate mitigation measures. Finally, to ensure Accountability, the Strategy conducts robust monitoring and reporting through direct collaboration with CalBio to track renewable natural gas production as well as emissions avoided annually and over time.

Figure 4: The 4A Criteria

The Broader Impact

Brookfield’s use of sustainability data and frameworks ensures that we hold ourselves to a consistent standard over time in assessing decarbonization progress. By taking a data-driven approach to decarbonization across these frameworks, we can uncover opportunities among our investments and make informed decisions on which decarbonization pathways they can follow.

We continue to integrate sustainability data throughout our investment process to drive value. We believe leveraging these processes and frameworks can contribute to value creation and preservation across all stages of the investment life cycle. We view our approach as accelerating decarbonization at an asset level initially, which over time can contribute to net-zero momentum at a firm-level. Furthermore, by sharing our insights with stakeholders, Brookfield contributes to the collective effort to transition the global economy.

Our commitment to transparency and accountability in our sustainability reporting is essential in progressing and reinforcing Brookfield’s reputation as a responsible steward of capital. In the coming years, our investors and broader stakeholders can expect additional updates on our progress as we steer our assets toward our decarbonization goals.

Endnotes:

- Invested AUM represents the total fair value of assets managed by Brookfield Asset Management Ltd. together with our asset management business, being Brookfield Asset Management ULC, and our subsidiaries as of December 31, 2023 adjusted to exclude uninvested capital, cash and cash equivalents, and investments where emissions would otherwise be double counted.

- Operationally Managed Investments represent investments where Brookfield may be able to broadly influence and control decarbonization outcomes.

- Expressed as the total fair value of assets managed by Brookfield Asset Management, Inc. and our affiliates excluding Oaktree Capital Management as of December 31, 2020.

- Represents assets included in Brookfield's NZAM interim target and the inclusion of additional assets as of December 31, 2023. Expressed as a percentage of total fair value of Operationally Managed Investments managed by Brookfield as of December 31, 2023.

- Please refer to the Brookfield Asset Management 2023 Sustainability Report’s Metrics & Targets section for a detailed discussion of our GHG emissions inventory and the results of plotting of our assets across our Achieving Net Zero Framework. https://www.brookfield.com/sites/default/files/2024-06/BAM_2023_Sustainability_Report.pdf

Sources:

- Brookfield Asset Management. (2024, June). 2023 Sustainability Report. https://www.brookfield.com/sites/default/files/2024-06/BAM_2023_Sustainability_Report.pdf

- Brookfield Asset Management. (2023, June). 2022 Sustainability Report. https://www.brookfield.com/sites/default/files/2023-06/BAM-2022-Sustainability-Report.pdf

- Brookfield Renewable Partners L.P. (2024) 2023 Sustainability Report. https://bep.brookfield.com/sites/bep-brookfield-ir/files/Brookfield-BEP-IR-V2/2024/bep-sustainability-2023.pdf

- Brookfield Renewable Partners L.P. (2023) 2022 Sustainability Report. https://bep.brookfield.com/sites/bep-brookfield-ir/files/Brookfield-BEP-IR-V2/2023/bep-esg-2022.pdf

- Brookfield Global Transition Fund. (2023, November). 2023 Operating Principles for Impact Management – 2023 Disclosure Statement. https://www.brookfield.com/sites/default/files/2023-11/bam-bgtf-opim-disclosure-statement-vf.pdf

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments offered or sponsored by Brookfield Corporation, Brookfield Asset Management Ltd. and/or their respective affiliates (together, "Brookfield"),and under no circumstances is this paper to be construed as a prospectus, product disclosure statement or an advertisement. In addition, the information set forth herein does not purport to be complete. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield.

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Past performance is no guarantee of future results. An investment in any security is speculative and involves significant risks, including loss of the entire investment. Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.