Driving Private Equity Returns With Operational Know-How

Financial engineering fades with cheap debt no longer an option.

Key Takeaways

- We see operational expertise as the dominant driver of private equity returns today and in the coming years, overtaking traditional financial engineering strategies that relied on low-cost debt.

- Managers should focus operational improvements in three key areas: commercial strategies, organizational structure and manufacturing operations.

- We are finding attractive opportunities, particularly carveouts, in industrials and financial infrastructure as companies in those sectors divest businesses.

- While the U.S. remains the deepest private equity market, we are finding attractive opportunities in Europe, Asia Pacific and, notably, the Middle East, where local governments are embracing transformative economic plans.

On almost all fronts, the private equity market is positioned for robust deal activity and strong performance in 2025 and beyond. Interest rates have fallen, valuations have stabilized and asset owners are more willing to sell than several years ago.

Yet the formula for success is changing. Because rates likely will remain well above the near-zero levels of the pre-pandemic period, private equity managers won’t be able to rely as heavily on cheap debt to finance their deals and stretch the value of an asset’s equity as they did several years ago. In other words, financial engineering will be much more challenging.

Instead, we see operational expertise as the key strategy private equity managers will need to employ to drive excess returns going forward. To add value, managers will need to roll up their sleeves and dive deep into their portfolio holdings’ product lineup, staffing and manufacturing operations, in our view.

3 Key Strategies to Enhance Operations

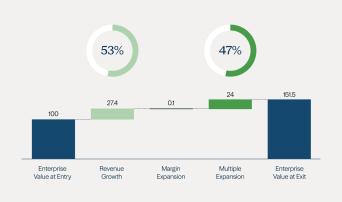

Over the past decade, many private equity managers used low-cost debt to buy assets. As financial markets rose, revenue at these acquired companies often increased as well. With this approach, managers benefited from multiple expansion to drive returns (see Figure 1).

Figure 1: Multiple Expansion Drove Value Creation From 2013–23

Median Indexed Value-Creation Drivers for Global Buyouts

Source: DealEdge powered by CEPRES data; Bain analysis. See endnote 1.

That strategy stopped working when central banks aggressively raised interest rates to tamp down inflation during the pandemic. The era of “free money” was over. It forced managers to work harder and focus on margin expansion—not multiple expansion—to earn their returns.

In our view, the most effective approach to expand margins and generate excess returns in today’s environment is to make substantial operational improvements to portfolio holdings. While interest rates have fallen recently, they remain elevated, which means private equity managers must continue to emphasize enhancing operations in their portfolio holdings. Effectively implementing this approach, however, takes time and a long-term track record.

Three critical areas to focus on to enhance operations include:

- Commercial strategies: Conduct a top-to-bottom review of a company’s products and services, global sales territories, acquisition strategies and governance practices. Opportunities exist at even the best-run businesses, including making refinements to pricing, focusing on the highest-quality growth investments and optimizing the company’s go-to-market approach.

- Organizational structure: Align the company’s structure with its business strategy, optimize the corporate hierarchy and headcount, and ensure strong management is in place.

- Manufacturing operations: Implement best-in-class processes, increase productivity and reduce fixed expenses to make high-quality products at a competitive cost.

Based on our experience, the operations team should have equal footing with a private equity firm’s investment team and should be involved from the first meeting with an acquisition target until the day the business is sold.

While operations professionals play a critical role in driving performance, we also see artificial intelligence (AI) enhancing their ability to implement all three of these key strategies. In our view, AI technology will help managers focus on high-value workflow, optimize manufacturing processes, automate computer coding, develop marketing plans, use company data to enhance business strategies, and assist with administrative tasks.

Investing in a New Era

This piece is part of our special report featuring perspectives across our global platform. Discover more insights about the opportunities we are seeing ahead. Explore now.

Where to Find Attractive Sectors

Opportunities exist in nearly every business sector, but we see two that offer the most value today and in the years ahead: industrials and financial infrastructure. In the industrials sector, capital goods and industrial component manufacturers make up about half the market, with some big subsectors such as packaging, specialty chemicals and aerospace building products rounding out the other half.

Slow deal flow in corporate America over the past three years has created a backlog of private equity investment opportunities. Industrial businesses, in particular, require substantial capital to upgrade their technology systems with AI tools and robotics as they strive to address labor shortages and enhance efficiency. With geopolitical tensions rising in recent years, many industrial businesses are also investing heavily to “reshore” manufacturing processes, which helps shorten and reinforce their supply chains. We see private equity managers stepping up to provide much of the capital that industrial companies will need to fund all these initiatives.

We have also found that many industrial companies are putting themselves up for sale or actively divesting their businesses. We have also seen potential buyers in the public markets often having little interest in acquiring these assets, which increases opportunities for private equity managers to offer financing options to the sellers.

Financial infrastructure is another compelling private equity opportunity, from online payment systems to money transfer businesses to wealth management platforms. Companies and people are seeking to transact faster and more often from any device, anywhere in the world. Yet much of the backbone that supports this infrastructure still operates on analog systems, and many of the world’s assets in this space are held by traditional financial companies that lack the expertise to transform them from old-world analog systems into new-age digital operations.

Key components of the global financial system are now at an inflection point, creating a critical need for scale capital, operating expertise and differentiated insights to support the businesses driving the movement of money (see Figure 2). The financial infrastructure investment opportunity, estimated at approximately $3 trillion,2 spans businesses that act as the critical enablement layer for the global financial economy, and many of these financial platforms, software developers and essential data services providers are high-quality operating businesses.

Figure 2: The Analog-to-Digital Evolution Will Require Significant Capital and Operating Expertise

Source: FIS, “Global Payments Report 2023,” Sep.2023. Roland Berger, “Tokenization of Real-World Assets,” Oct. 2023. Statista, “Bank encryption software market worldwide from 2018 to 2030,” Nov. 2023. IDC, “Worldwide GenAI Core IT Spending,” Dec. 2023.

As companies in the industrials and financial infrastructure sectors look to divest businesses, one of the key strategies that we see private equity managers employing today and in the years ahead is the corporate carveout. In a carveout, a parent company sells a business unit, division or subsidiary to a private equity firm. The private manager will then take significant steps to “stand up” the divested business as an independent entity. Improving operations by upgrading product lines, refining strategies, streamlining manufacturing operations and installing new executive teams can significantly enhance efficiency, increase sales and expand profit margins at the divested business.

In our view, the most effective private equity approach in both of these sectors is to identify companies that sell essential products and services, hold a dominant market share and generate recurring revenue. As industry leaders with high-margin businesses, many of these companies often overlook opportunities to cut costs and improve efficiency. Or perhaps a corporate parent has acquired several businesses over time but has fallen short of efficiently integrating them into the overall corporate structure. In these cases, private equity managers with exceptional operational strength and strategies to increase growth and efficiency will likely find these sellers receptive to investment offers.

Where to Find Regional Opportunities

The U.S. remains the biggest and deepest private equity market on the planet and presents the most opportunities across nearly every sector, particularly industrials. For decades, U.S. manufacturing growth stagnated as companies increasingly relied on international supply chains to shift production capacity offshore. As a result, capital investment and labor productivity declined at U.S. manufacturers, along with their competitiveness.

Today these trends are reversing. As technology advances and geopolitical tensions rise, many U.S. industries are realizing they can rebuild their domestic manufacturing capabilities. The rapid adoption of automation, robotics and machine learning is enhancing efficiency to lower costs, reduce waste, mitigate skilled labor shortages and improve global competitiveness. In our view, private equity will provide much of the capital necessary to achieve these goals.

We see Europe as an overlooked region with many assets available at significant value to private equity managers. We’re finding especially attractive opportunities to invest in leading global companies headquartered in Europe. That’s because these businesses benefit from a global customer base and production footprint—effectively insulating them from shifting global trade dynamics. Many of these companies can benefit from operational improvements to increase productivity and efficiency. We believe that a more complex trade environment demands deep industrial expertise and the ability to address significant capex requirements.

Asia Pacific is becoming an increasingly integrated region, and it offers attractive opportunities as well. Given continued shifts in supply chains, we are seeing buyout opportunities in pan-Asia businesses that are not only seeking capital, but also operational expertise and the ability to enhance executive teams and implement best practices.

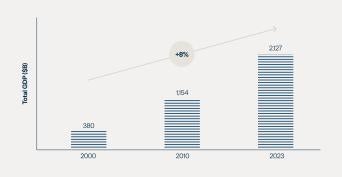

Finally, one region that is emerging quickly and gaining visibility on the private equity industry’s radar is the Middle East. The Gulf Cooperation Council (GCC) has experienced strong growth in gross domestic product (GDP) due to a growing population, significant infrastructure investment and expanding trade relationships (see Figure 3). And its strategic plans to diversify away from oil create opportunities for private capital providers with experience in the region.

Figure 3: Middle East GDP Is Growing Steadily

Source: IMF WEO Database.

As the region diversifies away from oil, governments are developing “vision plans” designed to reshape the economy with services-based industries that embrace digitalization and localization of supply chains. These trends will create enormous opportunities for “value-add” private capital providers with substantial operational expertise to finance initiatives highlighted in these vision plans, particularly in the business and consumer services, industrials, technology and healthcare sectors.

Endnotes:

- Note: Indexed to enterprise value at entry; includes fully and partially realized global buyout deals by year of entry; includes deals with invested capital of $50 million or more; excludes real estate; all figures calculated in U.S. dollars.

- Brookfield Internal research.

Disclosures:

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.