Europe’s Enduring Investment Themes

Even with Europe’s shifting geopolitical landscape, megatrends are expected to drive long-term opportunities in private markets.

Key Takeaways

- As the European geopolitical landscape continues to shift, we expect megatrends such as the “Three Ds”—digitalization, decarbonization and deglobalization—to continue to generate opportunities to invest in long-term value and growth in the private markets.

- Companies and governments across the continent generally continue to support renewable energy and domestic manufacturing, and economic conditions in Europe—especially overindebted governments—mean that private capital is more important than ever in advancing these priorities.

- Broadly, we see new opportunities for investment in critical infrastructure as European governments ramp up defense spending that may crowd out other priorities. Those opportunities will require new and innovative sources of funding. Europe's infrastructure requires an investment of approximately $15 trillion by 2040.1

- Changes in government and policy may have impacts on short-term drivers and create market noise, but we believe that few of them will change the principles that underpin these long-term trends and investment needs.

Out With the Old?

Following a banner year for elections, in which more people cast a ballot than ever before in human history,2 at least one trend is dominating headlines: a rejection of the status quo. Among developed countries, every governing party facing election lost vote share,3 regardless of their political ideologies. Europe, where voters headed to the polls in nine parliamentary elections,4 was no exception: Voters signaled support for new political parties and left mainstream parties struggling to hold onto power. And with recent developments in Germany and France, we continue to see changes in Europe—growing polarization has made it difficult to form coalitions, and the rise of far-right parties has scrambled the balance of power.

Incumbent Governments Worldwide Have Suffered Losses

Change in incumbent party seats or vote share compared to the last general election in democracies that held elections in 2024.

Source: Democracy Index, National Election Results, Time, via ABCNews. Note: Countries are considered democracies if their 2023 Democracy Index Score is 5.00 or higher.

Investing in a New Era

This piece is part of our special report featuring perspectives across our global platform. Discover more insights about the opportunities we are seeing ahead. Explore now.

Economic strain helped set the stage for Europe’s shifting political picture. Inflation put pressure on European citizens, corporations and governments alike. Although interest rates are normalizing and providing certainty to investors—the European Central Bank (ECB) now expects to hit its inflation target of 2% in 2025—years of inflation have effectively “baked in” higher prices for consumer goods and energy. Indeed, wages and purchasing power have not kept pace with cumulative 20%-30% inflation over recent years. European governments are also feeling the strain in their budgets, especially as they face additional pressure to ramp up defense spending amid conflicts in Ukraine and the Middle East.

Despite recession concerns after the rapid rate hikes, the financing environment in Europe has remained strong, as the worst-case economic scenario has not materialized. Of course, new trade policies also have the potential to reignite inflation or dampen growth, which could spur changes to ECB policy and interest rates.

While voters chose to shake up their governments, investors in the private markets should not have to make drastic changes to their portfolios—if they’ve focused on investment themes with staying power. The need for investment in critical assets—including those enabling renewable energy generation and transmission and domestic manufacturing—remains firmly in place. A new emphasis on defense spending could mean cuts to government investments in education, health care, transportation, energy transitions and more—further bolstering the need for private investment in essential assets and services. Given Europe’s widespread aging infrastructure, substantial investments in sectors like water, toll roads and power generation/transmission are needed. The funding gap presents both a challenge and a unique opportunity to deploy capital effectively.

Building Out Digitalization

Across Europe and the world, the artificial intelligence (AI) revolution is here. AI is already changing the way we live and work, and it’s opening new opportunities for investment in the technology—and, critically, the infrastructure—that supports it. AI also comes with the potential to place enormous strains on the existing grid and water resources (for cooling), and a need to mobilize finance at a level that the data center construction, renewable power, utility, fiber-optic and tower sectors have never seen.

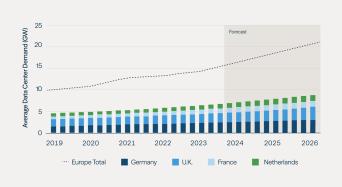

Data centers are key to Europe’s digital future and competitiveness, and we see no signs of this trend slowing down. Average European data center demand is expected to grow by around 25% between 2024 and 2026 (see Figure 1).5

Figure 1: European Data Center Demand Is Set to Double

Source: S&P Global Market Intelligence (451 Research).

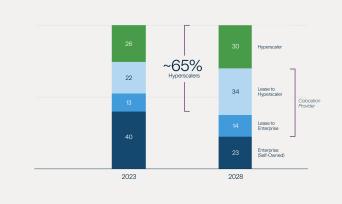

Hyperscalers—large data center tenants that consume vast amounts of power—are driving much of this demand (see Figure 2). Microsoft, for example, has pledged to inject $4.3 billion into its French cloud and AI operations by the end of 2024. And Brookfield acquired DATA4, a data center firm that operates 31 data centers across France, Spain, Italy and Luxembourg. Even with France’s political uncertainties, investors there are optimistic that lawmakers will continue to support startups and digital utilization as President Macron did, though taxes and labor laws make it more difficult for some companies to operate. There is also an expectation that European lawmakers will be focused on the ownership of AI capability, prioritizing “sovereign” providers outside of the reach of U.S legal control.

Figure 2: Hyperscalers Are Forecast to Drive Lion’s Share of Data Center Demand

Source: McKinsey. Note: Figures may not sum to 100% because of rounding.

The energy it takes to power these data centers is equally critical to the AI boom. Knowing that these data centers will require greater transmission capacity, we believe that investment in grid capacity across Europe will need to mirror large-scale investments in Latin America, Australia and the U.S. Companies like TDF, our leading independent communication infrastructure operator, are well positioned to provide essential data services and critical support to media broadcasting and telecom operators in France.

Likewise, Microsoft agreed to invest $10 billion in renewable energy projects to be developed by Brookfield, a commitment to bringing 10.5 gigawatts of generating capacity online in the U.S. and Europe. This agreement will advance Microsoft’s goal of having 100% of its electricity consumption, 100% of the time, matched by zero-carbon energy purchases by 2030. Importantly, this framework represents a never-before-seen approach to a longer-term commitment to securing clean energy.

Demand for AI infrastructure is here to stay, and investment at scale is needed at every stage of the value chain for data centers.

Powering Decarbonization

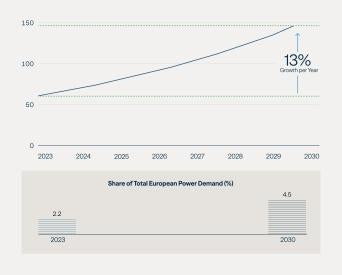

Essential to the infrastructure powering the AI revolution, clean energy continues to be a key focus for investors and an area of increasing demand (see Figure 3). European demand for clean energy is increasingly more a corporate pull rather than a government push. Corporations are increasingly demanding renewable energy simply because it is the cheapest form of power in most countries. Individuals are also signaling their support for cleaner energy sources for their homes and vehicles.

Delivering these new forms of energy requires greater collaboration among corporations, private capital and governments. Despite some governments in Europe being less able to contribute to clean energy projects—either due to budgetary pressures or political ideologies—private capital is filling in the gap. And many projects continue apace even when election results seem to threaten the status quo.

Figure 3: Power Demand for Data Centers in Europe Is Expected to Rise

Data Center Energy Consumption in Europe (Twh)

Source: Global Energy Perspective 2024, McKinsey. Note: Europe includes EU 27 + the United Kingdom.

Consider nuclear energy: There remains no visible way to achieve net zero without a large and growing role for nuclear energy, especially to provide “baseload” power (power that is constantly available). Nuclear also enhances Europe’s energy security needs. Our nuclear servicing portfolio company, Westinghouse, is capturing increasing market share in central and eastern Europe as countries shift away from Russian nuclear services and refueling. Westinghouse has also secured contracts to help construct a new fleet of nuclear power plants in Poland and is actively participating in small modular reactor (SMR) development opportunities in the U.K. Brookfield has held productive discussions with governments in France, the U.K. and Sweden to explore innovative financing models for developing greenfield nuclear projects. These discussions reflect our proactive approach in supporting Europe’s nuclear energy expansion, with an emphasis on creating financially sustainable models that align with the continent’s decarbonization goals.

Batteries are also an essential complementary component to renewable power. They can help reduce grid stabilization costs while facilitating the integration of renewable energy assets. With our recent investment in Neoen, we have become one of the world’s largest and most geographically diversified battery developers, with 15 gigawatt hours of utility scale batteries online by 2028.

Wind energy also presents new opportunities in Europe, with approximately 262 GW of wind power capacity expected by 2030, almost double its installed capacity over seven years.6 Irrespective of who controls the lower house of the French Parliament, the National Assembly, wind power is likely to grow as a critical part Europe’s energy supply.

Notably, we are seeing more opportunities to invest in offshore wind. Until recently, offshore wind did not provide an investment opportunity to ensure long-term value. Now, due to more competitive pricing and technological enhancements, we are identifying opportunities to acquire operating assets or advanced projects for attractive risk-adjusted returns, with value entry points significantly lower than what we have seen in the past.

The U.K.’s ambitious targets set out in the Clean Power 2030 plan call for 43-50 GW of offshore wind and 27–29 GW of onshore wind, acknowledging offshore wind as the “backbone of the clean power system.”7 The U.K. government ran a successful auction in 2024 to accelerate offshore wind projects. Great British Energy, a Labour Party initiative designed to drive progress on energy independence, also provides an avenue for offshore wind investment. Although the Conservative Party strongly opposes Great British Energy and its role is still being defined, it will be at least four years until the party could take power again, by which point we expect the capital will have been deployed and seen as a critical part of securing energy.

Despite political challenges in individual countries, Europe in general remains committed to renewable energy, which acts as a backstop against any government disinvestments in specific countries. Ursula von der Leyen, President of the European Commission—the European Union’s most powerful body—has signaled a commitment to advance the European Green Deal.8 The EU has locked in its target to increase the share of its energy consumption to renewable sources to at least 42.5% by 2030, with an aim of reaching 45%. As renewable energy becomes cheaper, it will further enable corporate growth and power emerging technologies.

Supporting Deglobalization

Domestic manufacturing and innovation continue to be top priorities for governments and businesses around the world, both for economic growth and geopolitical stability. Accordingly, the EU has advanced the Carbon Border Adjustment Mechanism, which seeks to fairly price the carbon emitted during the production of goods like steel, cement and some electricity, when imported to the European Union.

Europe is already a large manufacturing hub, especially in Germany. However, there is still room for many countries to focus on manufacturing critical, high-value items like semiconductors—often with government subsidies. World leaders in semiconductors such as TSMC, Samsung and Intel have announced or are considering major new investments in European semiconductor facilities. We see opportunities to partner with companies like these to assist in the buildout of domestic chip manufacturing as we are already doing with Intel in the U.S.

When it comes to the science & innovation industry, however, standing up domestic manufacturing and advanced research centers is easier in some countries than others. In the U.K., the Harwell Science and Innovation Campus (part of Brookfield’s Advanced Research Clusters, or ARC, business) is a joint venture of public and private investors where breakthroughs in physics and the life sciences are made. By contrast, in Germany, most research is done with public funding, and governments tend to finance facilities. There has been little room for private investors to participate.

Businesses and corporations count on enhanced supply chains to get manufactured goods where they need to go. Functioning supply chains provide predictability and stability, which can become more complex during times of geopolitical turmoil. Take the tariffs and protectionist policies that were proposed on campaign trails across Europe and the U.S. in 2024: Inconsistent tariffs around the world may yield multi-jurisdictional supply chains, in which goods make one or two stops before reaching their final destinations. Supply chains may also be further lengthened by global efforts to diversify away from China and into nations like Vietnam and India.

Thus, shifting supply chains also provide an opportunity for investment in transport infrastructure such as ports, rail and shipping. We expect transport infrastructure companies like Triton, the world’s largest owner and lessor of intermodal shipping containers and a Brookfield portfolio company, to benefit no matter where and how supply chains move.

More ‘Ds’ Ahead? Defense and Demographics

With a major war happening in Europe for the first time in 30 years, it is worth considering another potential D: defense.9 The changing geopolitical conditions could present opportunities in critical industrial supply chains that private investment can support—though not without risk.

Consider how the conflict in Ukraine affected supply chains and energy sources throughout the continent. In 2022, dwindling supplies of natural gas from Russia sent prices to record highs, forcing European countries to pivot to other sources. These included piped gas from Norway, liquid nuclear gas from Qatar and the U.S., renewable energy—and nuclear. Today, as the flow of gas through the Russian pipeline has halted, prices are expected to remain stable in the European Union.

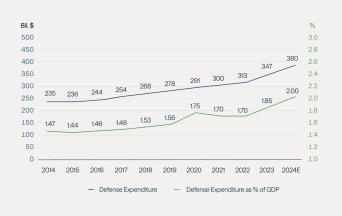

Overall, with the conflict in Ukraine in the East, the NATO alliance requires higher defense spending in the West (see Figure 4). As a result, the traditional level of spending by European nations on defense likely will not suffice in the years to come. A shift in European spending on defense may draw funds from other domestic priorities like infrastructure and research and innovation. As European governments look to raise new funding, they will likely turn increasingly to private investment to make up the difference—as they are already doing in the transition to clean energy.

Figure 4: Defense Spending Rises in Europe Among NATO Countries

Source: Defense spending – Allies Annual National Reports as of December 2023. GDP – OECD Economic Outlook, dated 29 November 2023 and from the European Economic Forecast from DG ECFIN, dated November 15, 2023. Via NATO, as of February 2024.

Real estate developers with experience in both innovation hubs and real estate conversion should be well positioned to meet European governments where such expertise is needed. In aerospace and defense, we have identified $25 billion in investment opportunities tied to carve-outs for industrial businesses seeking sophisticated capital solutions. And Westinghouse has provided much needed nuclear fuel services to Ukraine since the start of the conflict. The company recently began work on its AP1000 reactor in the country, with plans to build eight more.

While election results can be jarring to investors, long-term trends in Europe reveal several asset classes whose stability and growth can endure through even the most dramatic changes in government. Take Brookfield’s careful monitoring of trends in European demographics—another D—and subsequent investments in services that serve major generational groups through key life milestones.

The number of young people (16-19 years old) is forecast to rise by approximately 6% in Europe over the next three years.10 That’s one of the factors driving up enrollment in many of Europe’s top universities. Meanwhile, the supply of student housing can’t keep up. To meet this rising demand, private purpose-built student accommodation supply would need to grow four times, representing a €450 billion investment opportunity.11

These investments meet a specific need that will exist regardless of the political landscape. They are an example of private capital delivering on a challenge that traditionally would have been met by the public sector in Europe.

Brookfield constantly analyzes the range of possible scenarios to ensure that the thematic investments we focus on remain well positioned such that the outcome of any election or political event would not significantly affect our long-term strategy. That remains just as true even as the world grapples with the coming realities of ousting incumbent parties, with broader implications for trade, renewable energy and more. We continue to monitor trends and seek long-term growth, around the world, that can withstand short-term volatility.

Endnotes:

- Represents trends from 2016 to 2040 per the "Global Infrastructure Outlook" report published by Oxford Economics. Data sourced as of August 2023.

- Time, “The Ultimate Election Year,” November 2023.

- Financial Times, “Democrats join 2024’s graveyard of incumbents,” November 2024.

- Economist Intelligence, “Europe: elections to watch in 2024,” November 2023.

- S&P Global, “Data centers account for half of US clean energy procurement but only 20% in Europe: Report,” October 2024.

- WindEurope, February 28, 2024.

- U.K. Government, “Clean Power 2030 Action Plan: A new era of clean electricity,” December 2024.

- Reuters, “EU's von der Leyen vows not to weaken green policies in bid for new term,” July 2024.

- Geopolitical conflicts are not a theme that drives Brookfield’s investment activity, nor does Brookfield invest in arms or defense equipment.

- Savills, “Spotlight: European Student Housing 2022,” October 2022.

- JLL, “European PBSA: Investing in the future,” June 4, 2024.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.