Transition Opportunities Are Truly Electrifying

Renewables are now the lowest-cost source of bulk power in the world—spurring corporate demand to mobilize at dizzying speeds.

Key Takeaways

- An unstoppable rise in energy demand—driven by large global corporations—is accelerating far faster than forecasted just a few years ago, with renewable power expected to fill most of the gap.

- The cost of renewables has declined 90% since 2010—and today, it is by far the cheapest form of electricity generation in most regions of the world.

- While policy shifts in the U.S. have caused market uncertainty in the renewables space, the industry’s fundamentals remain strong.

- We are seeing compelling opportunities for private capital providers across the spectrum of decarbonization technologies—including renewable power, batteries, nuclear and sustainable aviation fuel.

The global demand for electricity is accelerating at an unprecedented rate, outpacing prior forecasts and reshaping the energy landscape. Driving this surge are large corporations looking for reliable, low-cost energy solutions. Enter renewables, the cheapest source of bulk power in most regions of the world.

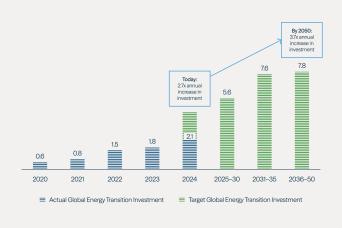

As a result, renewable power is playing a leading role in the “any and all” approach to increase generation capacity. Two decades from now, annual energy transition and grid investments must reach $7.8 trillion—a 3.7x increase from today’s annual investment—to achieve net zero (see Figure 1). For investors, we believe that renewables offer both immense growth potential and attractive risk-adjusted returns with embedded downside mitigation.

While some recent developments have caused some volatility in the renewable power industry—including shifting U.S. policy and the implications for a new artificial intelligence (AI) model from DeepSeek—they also have positive implications for energy and renewables demand that we believe markets have not priced in. Investors who focus on the lowest-cost, most mature renewable power and transition technologies—which are experiencing the greatest demand from corporate customers and are not reliant on government subsidies—are best positioned to benefit in the current environment, in our view.

Figure 1: Transition Investing Will Accelerate Over Decades

Source: BloombergNEF (BNEF), “Energy Transition Investment Trends 2025;” Future values from BNEF, “New Energy Outlook 2024.”

Investing in a New Era

This piece is part of our special report featuring perspectives across our global platform. Discover more insights about the opportunities we are seeing ahead. Explore now.

The Unstoppable Rise in Demand for Electricity—and Renewables

Energy forecasts at the end of 2020 predicted that it would take 10 years for demand to increase by 25%. Instead, it took just four years. From today’s vantage point, the growth forecast is stronger than ever due to factors such as increasing electricity needs for industrial, manufacturing and data center activity.

We are seeing renewable power capture a disproportionate amount of that growth. The reason is simple: Since 2010, the cost of renewables has declined by 90%—and today, they are by far the cheapest form of bulk power available in most markets globally (see Figure 2). They are also easier to deploy and provide a secure supply of energy because they don’t rely on commodities, like gas or coal, that require procurement from third parties.

Figure 2: Economics are Pushing Corporates to Renewables

Global Levelized Cost of Electricity Trend

Source: BNEF, “LCOE Global Benchmarks.”

Corporations are the single largest driving force behind this increasing demand for renewables. Large global technology companies have become the main buyers of renewable energy to power their data centers and operations. That, along with the electrification of a wide range of industries, has resulted in a 12-fold increase in corporate power purchase agreement (PPA) volumes since 2016.1 Today, corporate demand from these “hyperscalers” is exceeding, by far, the renewable projects that are available to supply it.

For example, Microsoft and Brookfield announced in May 2024 the signing of a global renewable energy framework agreement to contribute to Microsoft’s goal of having 100% of its electricity consumption, 100% of the time, matched by zero-carbon energy purchases by 2030.2 The agreement provides a pathway for Brookfield to deliver over 10.5 GW of new renewable energy capacity between 2026 and 2030 in the U.S. and Europe, and the scope could potentially expand to deliver additional renewable energy capacity within the U.S. and Europe, and beyond to other regions.

This corporate demand is mobilizing at dizzying speeds. In 2023, Amazon achieved its goal of matching 100% of the electricity it consumed across its operations with renewable energy, seven years ahead of its original 2030 goal; Meta is matching its electricity use with 100% renewable energy and has set a net-zero goal across its value chain by 2030; and Google aims to achieve net-zero targets across all of its operations and value chains by 2030 by reducing its emissions by 50% and investing in nature-based and technology-based carbon removal solutions to neutralize its remaining emissions.3,4,5

These hyperscalers have committed to the most aggressive decarbonization targets across businesses in different sectors—and the fastest and easiest way to get there is through renewable power. But here’s the bottom line: Regardless of net-zero targets, companies will seek to secure as much renewable power as they can simply because it’s the cheapest.

The Race to Power Data Centers

AI is poised to transform every industry worldwide, fueling explosive growth in data center construction to compute and store the enormous volume of data created. Global data center power demand is expected to rise 15-fold by the end of this decade.

But access to power in high demand regions is increasingly the bottleneck hindering data center and AI development. Businesses are now ramping up their efforts to lock in supply to ensure they can achieve their growth targets—and they are looking to power all these new data centers with renewables.

Recently, Chinese AI startup DeepSeek made headlines with the news that its advanced models reportedly achieved comparable results to leading U.S.-based AI labs while using less-expensive hardware, less computing power and less energy. The DeepSeek announcement surprised many in the industry, leading to initial market volatility in the renewable power sector. Yet, AI implementation was never expected to be linear, and AI deployment will continue to require significantly more computing power and energy for inference and model training than is currently available, in our view.

If DeepSeek and other models emerge to make AI cheaper, it will likely accelerate AI adoption for training and inference models, robotics and other promising technologies. In other words, cheaper AI is likely to spur more demand for AI—and subsequently more power. We view this as positive for continued long-term demand for data centers and new energy infrastructure.

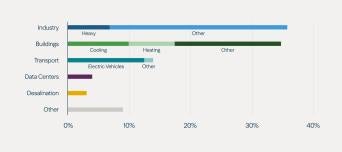

Also, it’s important to remember that the expected increase in electricity demand is due to much more than just data centers—industry, buildings, transport and other sectors are all demanding more power (see Figure 3).

Figure 3: Electricity Demand is Diversified Across Sectors

Share of Increase in Global Electricity Demand by Sector (2023–2030)

Source: Nat Bullard, “Decarbonization: 2021 Things, The Complex, Reagents.”

Clean Energy Solutions Are Stepping Up to the Plate

Solar has made incredible leaps and is on course to be the largest source of generating capacity for electricity by mid-2035.

To put it in perspective, back in 2004, it took an entire year for solar sources to produce a gigawatt of power. Now it takes just half a day. But electricity grids always need to be balanced between supply and demand—and while sunshine and wind are plentiful and free, they’re not available 24/7.

Companies need access to stable, consistent baseload power. To complement wind and power, they require a diverse range of decarbonization solutions to mitigate the intermittency challenges from traditional renewable sources and to decarbonize hard-to-abate areas of their business. These decarbonization solutions are at various stages of scaling, ranging from well-established technologies like wind, solar and large-scale nuclear to rapidly maturing options such as batteries and sustainable aviation fuel (SAF). And over the longer term, technologies like small modular reactors (SMRs), microreactors and hydrogen show a lot of promise.

But today, three technologies are making notable strides: nuclear, batteries and SAF.

Nuclear

Currently, nuclear is the only commercially viable provider of baseload carbon-free power. Over time, technological advances, shifting public sentiment, the need among governments for energy security and increasing corporate demand have resulted in a nuclear industry resurgence.

Indeed, several global technology players have recently announced plans to restart or enable the development of nuclear capacity. For example, Microsoft signed an agreement in 2024 to restart the Palisades reactor in Michigan, which had been decommissioned in 2022, to serve its data center footprint. And Meta announced that it is seeking up to 4 GW of new nuclear power to help meet its AI and sustainability objectives.6 Hyperscalers need reliable, low-cost, stable baseload solutions at scale—and they are increasingly looking to a small number of trusted partners to deliver what they need, where they need it and when they need it.

These tailwinds have resulted in life extensions for an increasing number of existing nuclear reactors as well as renewed interest from federal and local governments expanding nuclear power by building new plants. About 30 countries—ranging from sophisticated economies to developing nations—are considering, planning or starting nuclear power programs.

Looking ahead into the next decade, advances in SMRs and microreactors are opening up new possibilities for nuclear power applications—particularly for behind-the-meter and off-the-grid use by industrials, technology and mining companies, as well as remote communities. These innovative solutions are not only more flexible and scalable but also offer enhanced safety features. The development of long-duration energy storage systems further complements nuclear power, making it an even more attractive option for meeting future energy needs. While full-scale deployment is still several years out, we expect small-scale nuclear to form part of the long-term energy solution.

Batteries

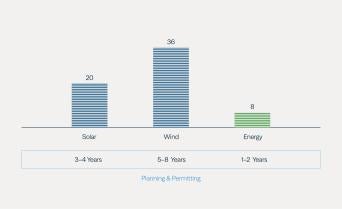

Battery prices have dropped dramatically over the past few years, following a trajectory similar—but faster—than what we saw with solar. This was mainly due to improving technology, economies of scale, market dynamics and a fall in prices of critical battery metals like lithium, cobalt and nickel. For example, lithium carbonate prices fell from a high of approximately $70,000 per metric ton to well below $15,000 in 2024.7 Batteries now also require less time to plan and install than solar and wind systems (see Figure 4).

Figure 4: Batteries Are Cheaper and Easier to Develop Than Solar and Wind Systems

Total Development Expense Until Ready to Build ($ per kW)

Source: Brookfield internal research.

Batteries are also playing a critical role in enabling the increased penetration of renewables into the energy system. As more solar and wind is deployed, storage capabilities are needed to provide grid stability. The grid-scale batteries being developed today are able to charge when the sun is shining and when the wind is blowing and then discharge power at other times, enabling a more consistent supply of power. And revenue frameworks for batteries have also evolved. As grid operators and regulators have recognized the need for battery storage, they’ve developed contractual structures and regulated revenue streams that support the long-term economics of batteries, giving this asset class infrastructure-like characteristics.

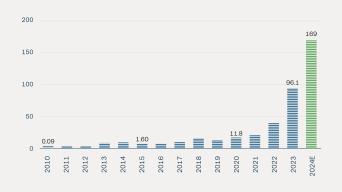

Batteries are becoming an essential renewables asset class. Already, global battery energy storage capacity additions have increased 76% from 2023 to 2024 (see Figure 5). From 2024-2040, $148 billion of annual investment is required to reach net zero—four times more than in 2023.8

Figure 5: Battery Storage Capacity Keeps Increasing

Annual Battery Energy Storage Installations (GWh)

Source: Nat Bullard, “Decarbonization: 2021 Things, The Complex, Reagents,” January 2025.

Renewables are expected to one day deliver enough capacity to meet electricity demand peaks and provide critical grid-stabilizing and ancillary services. Batteries will play a crucial role in achieving that, making energy production more efficient and creating value for renewable platforms. Today, growth in both solar and batteries is breaking records,9 a trend we expect to continue over the next decade.

Sustainable aviation fuel

SAF is considered one of the only viable near- and medium-term pathways to decarbonize the hard-to-abate long-haul air transport sector. It is produced by combining hydrogen generated from renewable electricity with captured carbon dioxide. It is considered a “drop-in” fuel, meaning the same jet engines can operate on either SAF or traditional jet fuel or a mixture of both. Crucially, it enables a significant reduction in carbon dioxide emissions relative to the same volume of conventional jet fuel.10

Similar to solar and wind, SAF is a proven technology seeing increasing demand from airlines and corporations seeking long-term take-or-pay contracts to secure supply to meet their net-zero targets and regulatory requirements. SAF benefits from significant policy tailwinds contributing to the supply demand. For example, under RefuelEU, a component of the European Union Green Deal, all planes refueling at European airports must use a blend containing a minimum percentage of SAF starting this year.

SAF is at the point where both the technology and the commercial uses are ready to go—and the tailwinds in this sector are strong. Fourteen airlines, controlling half of the market for jet fuel, have SAF targets,11 suggesting strong long-term demand for this technology. According to a study by the World Economic Forum and Kearney,12 global SAF demand is expected to reach 17 million tonnes per year by 2030, about 5% of total jet fuel consumption. By the end of 2024, production capacity was expected to be 4.4 million tonnes per year, with an additional 6.9 million tonnes per year expected from new refineries and facility expansions. However, to meet 2030 demand, an extra 5.8 million tonnes of production capacity is needed by 2026.

The Effects of Shifting U.S. Policy

The new U.S. administration has introduced some market uncertainty around renewables. However, we believe fundamentals for power remain exceptionally strong and we expect demand to continue to outpace supply, driving growth in required energy capacity—regardless of what happens in Washington.

Today, demand for clean power is driven by a “corporate pull” due to its position as the lowest-cost form of bulk power in most markets, which will continue to support new and existing projects. Certain industries, such as U.S. offshore wind, wind on federal land, and electric vehicles, will likely be affected by U.S. policy changes, but most technologies will not. In our experience, focusing on low-cost renewable power and decarbonization technologies and high-growth regions allows developers to mitigate impacts on their businesses from regulatory or subsidy changes.

The U.S. has indicated that it will take an “all of the above” approach to providing energy and solidifying its energy dominance. Given how integrated renewables are in the energy mix, they will continue to supply domestic energy as well as support exports of any potential surplus in the country’s oil production. With respect to fully repealing the Inflation Reduction Act (IRA), we still feel it would be difficult because not all Republican lawmakers support such a drastic step. The IRA has generated significant investment in new clean energy projects while creating a meaningful number of jobs, directly benefiting Republican states.

While shifting U.S. policy does introduce some (manageable) risks into the renewable power sector, we believe that other positive developments have captured less attention in the markets. For example, the new administration is expected to drive significant growth in U.S. industries through its focus on manufacturing and data center development. This would likely generate incremental power needs on top of the already significant demand growth and supply-demand fundamentals that we are seeing today. The “any and all” approach in the U.S. will benefit renewables, as the lowest-cost source of power, as well as other forms of generation such as gas and nuclear.

Opportunities Ahead

Despite the market uncertainty stemming from recent global and regional events, the fundamentals for renewable power have never been better. In our view, this dynamic is creating significant opportunities to acquire assets for value.

Corporate demand is driving enormous growth opportunities for investors across renewable power and decarbonization technologies globally. But the need for capital is just the beginning—development expertise and capabilities are also in short supply. Many of the world’s largest and fastest-growing companies with the greatest access to capital are increasingly looking to partner with private capital providers to help them achieve their most critical and large-scale decarbonization and power needs. They are choosing the developers that offer scale, flexible structures and a diverse range of decarbonization technologies.

For investors, these dynamics are creating a once-in-a-generation opportunity to drive both meaningful impact and economic growth.

Endnotes:

- Bloomberg New Energy Finance (BNEF).

- Brookfield, “Brookfield and Microsoft Collaborating to Deliver Over 10.5 GW of New Renewable Power Capacity Globally,” May 1, 2024.

- Amazon, “Carbon-free energy.”

- Meta, “Sustainability-Energy.”

- Google, “Net-zero carbon.”

- Meta, “Accelerating the Next Wave of Nuclear to Power AI Innovation,” December 3, 2024.

- S&P Global, “BriefCASE: Where are EV battery prices headed in 2025 and beyond?” January 8, 2025.

- BNEF.

- Deloitte Research Center for Energy & Industrials, “2025 Renewable Energy Industry Outlook,” December 9, 2024; EIA, “Short-term energy outlook data browser table 7e: US electric generating capacity,” November 13, 2024.

- Infinium, a Brookfield portfolio company.

- Credit Suisse, “Sustainable Aviation Fuels Primer,” March 2023.

- World Economic Forum, Kearney, “Financing Sustainable Aviation Fuels: Case Studies and Implications for Investment,” February 2025.

Disclosures:

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.