The following is an abridged conversation that includes selected portions of the webcast.

Ruth Kent: Let’s kick things off with the economy. Mark, given your perspective, where are we in terms of the recovery?

Mark Carney: We're at the start of what could be a strong economic expansion. Everywhere that has opened up, or is in the process of opening up, is turning out strong underlying growth. There's tremendous pent-up demand from consumers. There's a lot of stimulus still in place, both monetary and fiscal. But I think what's exceptionally encouraging is that we see it on the business survey side. We see it in some of the durable goods orders. We see it in early stages of capex. And business confidence is coming back very strongly. So that indicates the prospect of a very rapid recovery: 7% global growth this year, probably 5% global growth next year—numbers I only dreamed of when I was a central bank governor. But turning these early indicators into sustained momentum is the key to delivering the type of recovery that we deserve.

Kent: What about inflation?

Carney: The first thing to say is I'd rather have that as the issue than the alternative. And the second is we need to make a distinction between what's transitory and what could be persistent. For example, we have seen some shorter-term bottlenecks in the building trades and lumber, but those have started to come off. The real question is what's happening in the labor market. How many people have withdrawn from the labor pool because they've retired early, or because they've lost some skills? Or is it more temporary in nature? Don't forget, a lot of the support programs are still in place, and we're just starting to open up. So, as we get into the latter part of this year and into 2022, we're going to discover where things truly stand.

A key point, though, is that central banks want to make sure this recovery really gains traction and turns into an expansion. So, they're holding back a bit right now. There will be this overshoot of inflation in the near term and then an adjustment that comes thereafter. But again, those are the types of issues you'd rather be dealing with, than coming out of the gate too slow. Then the question increasingly becomes, what's the pace of easing off on stimulus? And note that’s opposed to tightening policy—there is a difference between the two.

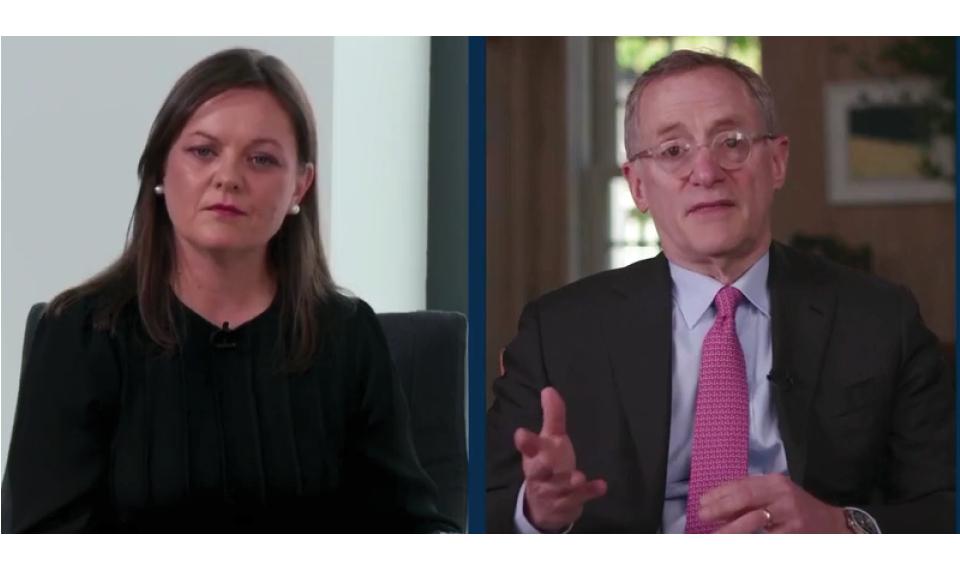

Kent: Howard, where are you finding value today?

Howard Marks: Value is much better in private markets than public markets. Sometime in the last decade, one of my peers said, cleverly, that everything with a CUSIP is overvalued. That is to say, when you have public securities, it’s extremely easy for money to find its way there and lift the prices. This is not nearly as true in the private markets, which are less efficient.

The less competition there is to buy, the higher the probability that you can find a bargain. This includes nonpublic assets, which means real estate, real estate debt, companies, structured credit and so forth. Also, everyone is sold on the strength of the U.S. economy and not as confident in the rest of the world. So, Europe may be cheaper than the U.S., and the emerging markets may be cheaper than the developed world.

Kent: What risks do you think are underappreciated in the market today?

Marks: I think that the world is not yet convinced there will be hyperinflation, as I am not. But if we do get hyperinflation, it will be a bump in the road at minimum, depending on how much it grows to and how strong the inflationary expectations become and how embedded. At the same time, I believe that the macro is unknowable, and we just have to keep working at being strong value investors from the bottom up. Our investments are not governed by macro forecasts, but by the identification of good assets that can be bought for good, solid returns with the risk under control.

Kent: Anuj, how do you manage risk when you're looking to invest?

Anuj Ranjan: Throughout the world, we attach a risk premium to every market we invest in, and there are a variety of components that make up that risk on the commercial side of any business. We mitigate that partly through having a deep knowledge and capability in each of these countries. As Bruce has said, we like to invest where there is a respect for capital. And that is one of the key themes we bring to all the markets we enter. We're pretty conservative in how we approach our growth. We always try to limit the perceived risk and capture the real risk in any premium that we underwrite when we look at investments.

Kent: Is the risk/return worth it in the emerging markets?

Ranjan: The short answer is yes, but it takes a lot of time and it takes a lot of effort. It isn't as easy as showing up in a country and making an investment or hiring a few people and opening an office. In India, for example, we've been in the country for 15 years—but the majority of our investments have been made in just the last five years. Building that local knowledge, the capability and the operating platforms that we need to invest over those first 10 years, took quite a bit of effort and patience. Out of the $20 billion of assets that we have under management in India, over $11 billion was deployed since the pandemic began.

Ranjan: Ruth, you’ve spent a lot of time in India. What are your thoughts?

Kent: I agree completely. Our renewable power team has been there a few years now and, as you know, one of the advantages of having operations on the ground is deal flow—as well as some downside protection. What we're finding is a lot of deals are starting to come through to our M&A team, with developers getting in touch with local operators that they know.

Kent: Bruce, there’s a lot of money out there looking for returns. What are you seeing?

Bruce Flatt: When the public markets are priced to more perfection than what you would otherwise want, it's a good time to sell. We've been selling a lot of things in the last six months—not because they're not great assets, but because we can either return that capital to our investors, or we can take our portion of it and reinvest it back into imperfect things. The arbitrage that we're always trying to thread the needle on is to find and purchase assets when they're imperfect and sell them into a much more perfect market.

Kent: Can you speak to the idea that government indebtedness will lead to infrastructure opportunities for us?

Flatt: We’ve been saying that for 15–20 years. More government assets are going to be privatized, and that’s going to create opportunity for investors—and it has. Two things have increased the trajectory of that idea. One is that interest rates went to zero. Therefore, lots more money needs private alternatives. The second is that governments have issued so much debt. They haven’t figured out what they are going to do to pay it back, and there are only two options: Tax more and/or sell assets. And those assets are generally infrastructure assets. I think the opportunity is going to be very significant for infrastructure.

Kent: Mark, are governments thinking about this?

Carney: They certainly are. How early they're thinking about it depends on the quality of the government, but they are. And that is one of the trends I think we're going to see in the middle of this decade and beyond. We're seeing it in a number of emerging markets as well—as one example, Brazil is starting to move on the privatization side.

The other thing on top of this is the issue of sustainability. Governments need to kickstart that process, and it’s measured in trillions of extra dollars every year. They’re starting to put in place the regulations, the price on carbon, so that the private sector can build out more sustainable infrastructure. And that's what we're doing at Brookfield; the two go together.

Kent: Bruce, what about private markets versus public markets in real estate?

Flatt: Other than in niche or growth sectors, real estate generally doesn't accord itself to the public markets unless it's an income product. The issue with real estate is it's a total return asset. It generates income and generates capital appreciation—and often, you're making decisions that destroy current cash flow but build a lot of long-term value. And that takes years to show up. Our private clients who invest with us are thrilled with that. But the public markets don’t understand it.

Flatt: Ruth, are you seeing commercial customers wanting to contract more renewable power than a few years ago?

Kent: 100%. Four or five years ago, we were knocking on doors asking people if they wanted to buy renewable power. Now, they're knocking on our door. It's a totally different world. Companies are coming to us and asking for help with their emissions.

Carney: That’s a CEO-level conversation as well. It starts as one of top three strategic issues and then cascades down through the organization. And given that large U.S. organizations tend to be global, that becomes a global question—and ultimately will require a global partnership to address it.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Inc. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.

Explore More Insights