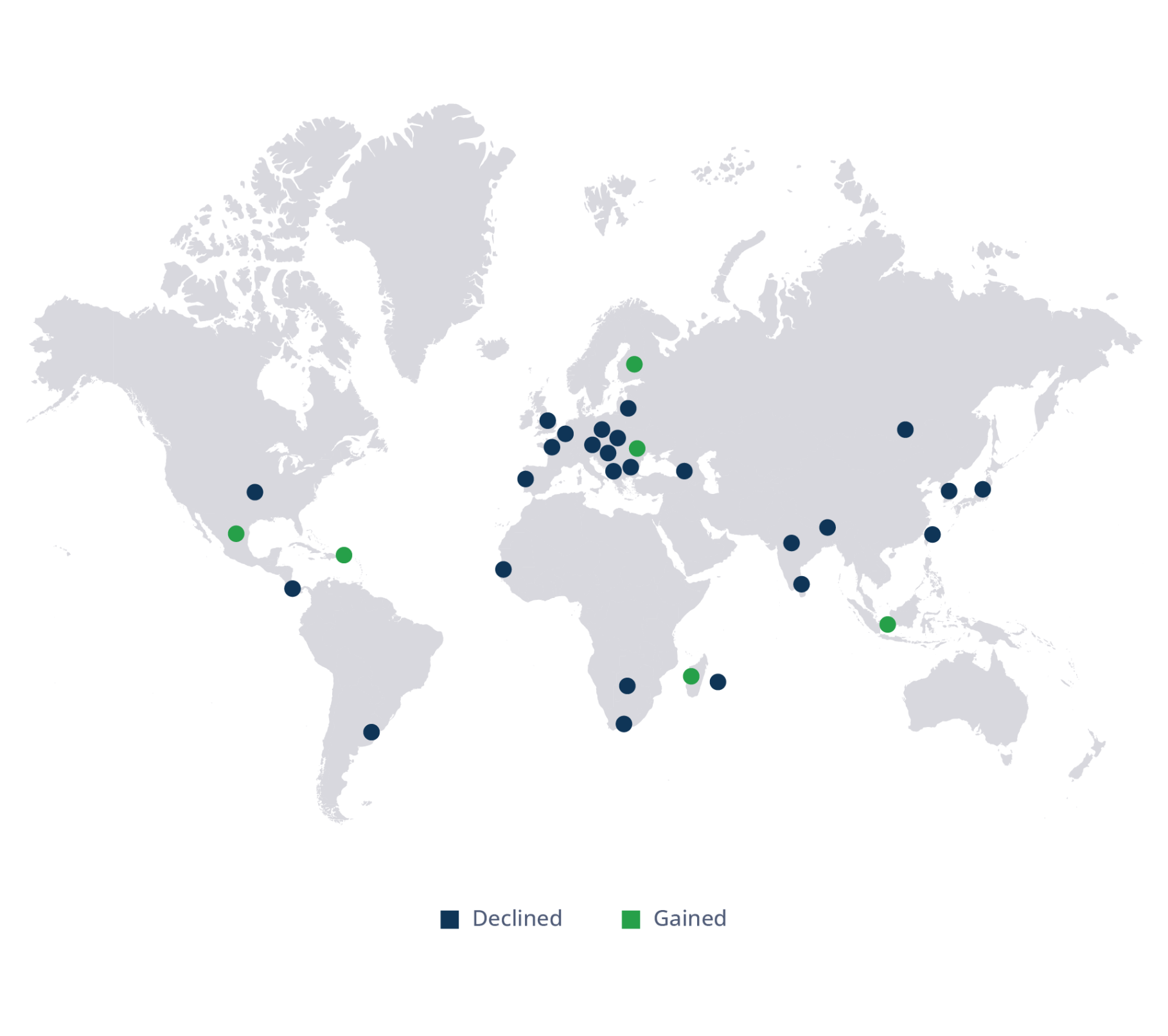

Consider nuclear energy: There remains no visible way to achieve net zero without a large and growing role for nuclear energy, especially to provide “baseload” power (power that is constantly available). Nuclear also enhances Europe’s energy security needs. Our nuclear servicing portfolio company, Westinghouse, is capturing increasing market share in central and eastern Europe as countries shift away from Russian nuclear services and refueling. Westinghouse has also secured contracts to help construct a new fleet of nuclear power plants in Poland and is actively participating in small modular reactor (SMR) development opportunities in the U.K. Brookfield has held productive discussions with governments in France, the U.K. and Sweden to explore innovative financing models for developing greenfield nuclear projects. These discussions reflect our proactive approach in supporting Europe’s nuclear energy expansion, with an emphasis on creating financially sustainable models that align with the continent’s decarbonization goals.

Batteries are also an essential complementary component to renewable power. They can help reduce grid stabilization costs while facilitating the integration of renewable energy assets. With our recent investment in Neoen, we have become one of the world’s largest and most geographically diversified battery developers, with 15 gigawatt hours of utility scale batteries online by 2028.

Wind energy also presents new opportunities in Europe, with approximately 262 GW of wind power capacity expected by 2030, almost double its installed capacity over seven years.6 Irrespective of who controls the lower house of the French Parliament, the National Assembly, wind power is likely to grow as a critical part Europe’s energy supply.

Notably, we are seeing more opportunities to invest in offshore wind. Until recently, offshore wind did not provide an investment opportunity to ensure long-term value. Now, due to more competitive pricing and technological enhancements, we are identifying opportunities to acquire operating assets or advanced projects for attractive risk-adjusted returns, with value entry points significantly lower than what we have seen in the past.

The U.K.'s ambitious targets set out in the Clean Power 2030 plan call for 43-50 GW of offshore wind and 27-29 GW of onshore wind, acknowledging offshore wind as the "backbone of the clean power system.”7 The U.K. government ran a successful auction in 2024 to accelerate offshore wind projects. Great British Energy, a Labour Party initiative designed to drive progress on energy independence, also provides an avenue for offshore wind investment. Although the Conservative Party strongly opposes Great British Energy and its role is still being defined, it will be at least four years until the party could take power again, by which point we expect the capital will have been deployed and seen as a critical part of securing energy.

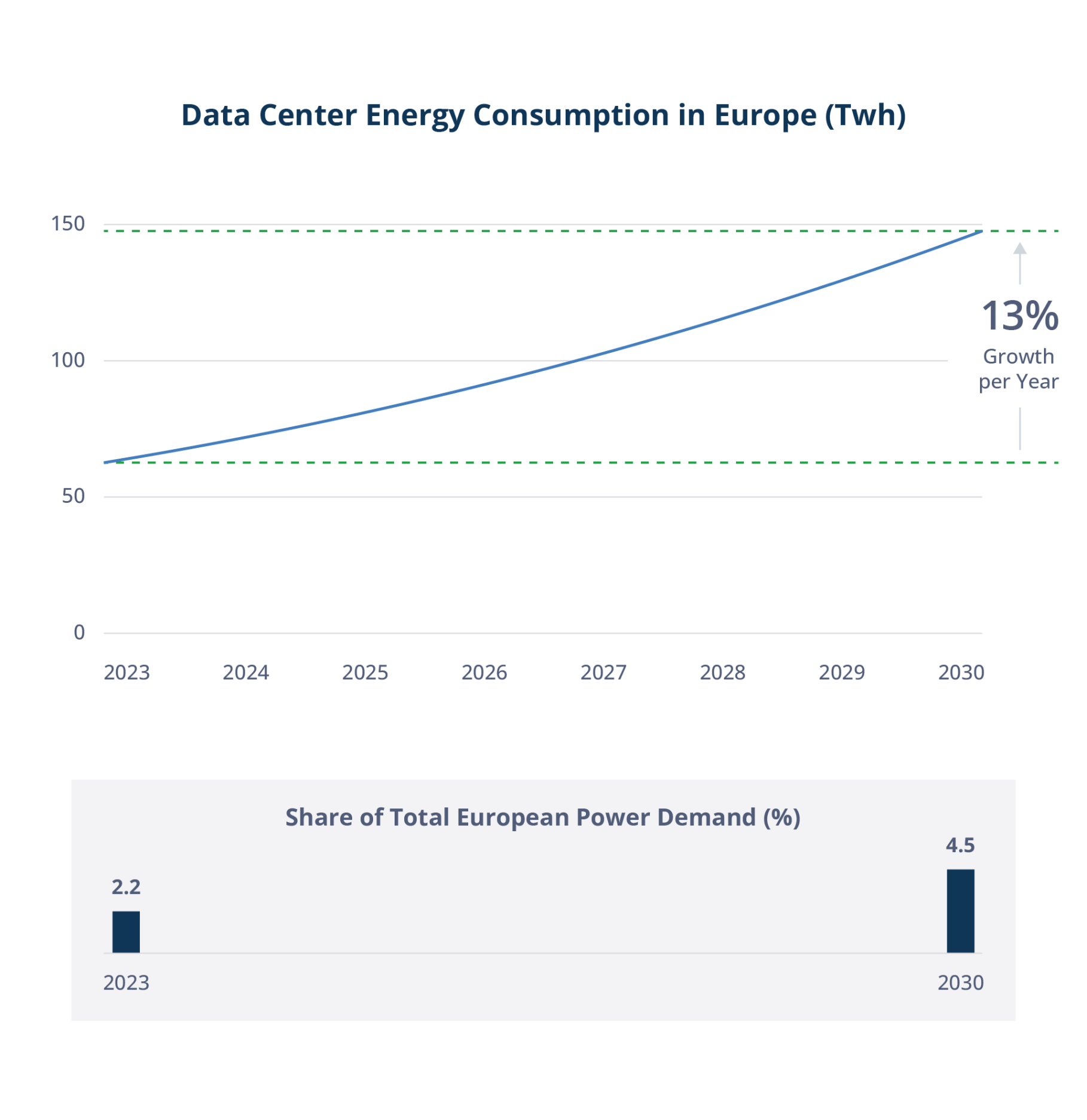

Despite political challenges in individual countries, Europe in general remains committed to renewable energy, which acts as a backstop against any government disinvestments in specific countries. Ursula von der Leyen, President of the European Commission—the European Union’s most powerful body—has signaled a commitment to advance the European Green Deal.8 The EU has locked in its target to increase the share of its energy consumption to renewable sources to at least 42.5% by 2030, with an aim of reaching 45%. As renewable energy becomes cheaper, it will further enable corporate growth and power emerging technologies.