Finding Solutions

There are bright spots in the transmission story, as well as sensible proposals to address the issue of constrained transmission infrastructure.

China and India, and several other emerging economies, have invested heavily in their grids in recent years to extend electrification to all their regions, and so they are not as restricted by aging infrastructure.

In one positive example among developed economies, about 20 years ago policymakers in Texas began an ambitious plan to harness renewable energy from windy West Texas and build transmission to move that power to populated centers in East Texas. In 2005, the Texas legislature instructed the Public Utility Commission of Texas (PUCT) to designate competitive renewable energy zones (CREZs) and develop a transmission plan to deliver renewable power from those zones to customers.

The PUCT’s plan—made with consultation from the Electric Reliability Council of Texas—has since been completed and offers insights into successful regional planning and execution.

The project now includes five CREZs totaling 32,000 square miles, 23 GW of new wind energy and 3,600 miles of new transmission lines, representing 23% of all high-voltage lines added in the U.S. in the 12 years ending in November 2020.20 Texas now leads the nation in wind power.

To be sure, Texas’ grid still failed in 2021 due to a radical winter storm, but that does not belie the significant progress of the CREZs. In fact, the progress in Texas illustrates how proactive and coordinated planning across regions and a balanced cost-sharing framework can be part of the solution for alleviating transmission constraints.

It is clear from such examples that, similar to interstate highways built after WWII, interstate transmission lines will require coordination of state and federal authorities across state lines, as well as investment from utilities.

FERC, in addition to the requirement of grid operators to prioritize “ready” renewable projects, also approved penalties for grid operators that fail to complete interconnection studies on time, stricter financial requirements for applicants to screen out speculative proposals, and changes that could facilitate battery integration into grids.

Developers have expressed support, though they say much more needs to be done to address the backlog of renewable projects waiting to connect to a grid.

In addition, FERC in May issued an order instructing grid operators to engage in more long-term planning beyond individual projects, including development of new regional transmission lines. However, critics have said the agency needs to provide clearer guidance on how cost sharing would occur for projects across state lines.21

Also in May, the Department of Energy announced 10 proposed National Interest Electric Transmission Corridors, which are designated geographical areas where transmission lines and other transmission projects could be expedited. Transmission projects in these areas will benefit from a streamlined siting and permitting process, be prioritized and available for incumbent utilities to execute, and be eligible for public-private partnership funding and direct federal loans.22

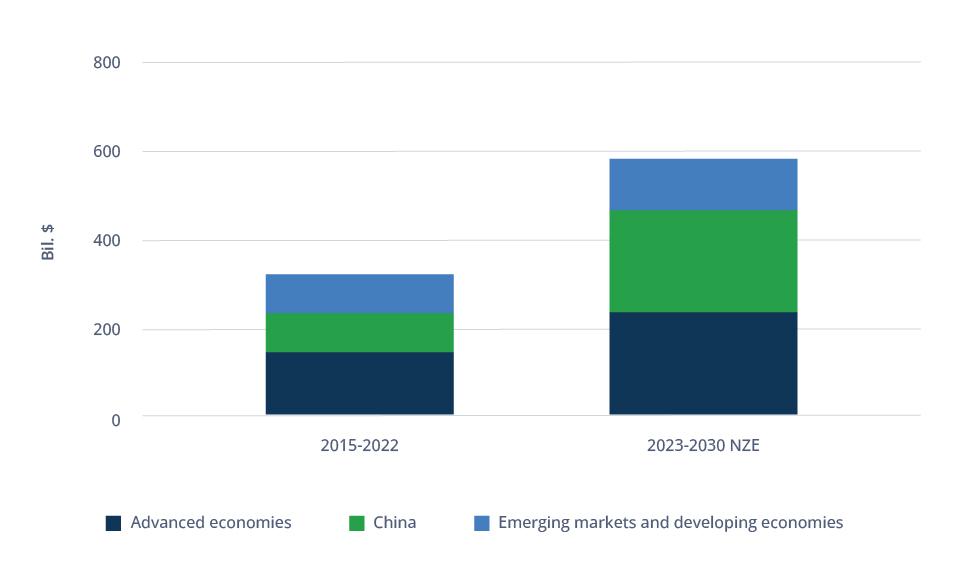

Similarly in Europe, the European Commission in November 2023 announced plans to facilitate investment in energy grids. The plan seeks to advance the improvement of long-term planning of grids to accommodate renewables, stimulate faster project permitting, and other goals. In a statement, the commission said, “With 40% of our distribution grids more than 40 years old and cross-border transmission capacity due to double by 2030, €584 billion in investments are necessary.”23

The EU is also taking steps to facilitate interconnection between national grids to accommodate renewable energy and bolster the ability of neighboring countries to rely on each other in times of stress. The union has set a target that each grid should have interconnection equivalent to 15% of its system total by 2030.24

The Office of Gas and Electricity Markets, which regulates energy in Great Britain, licenses independent network operators (IDNO) to develop and operate electricity distribution, thus operating as a third party to extend grid access. Energy developers may find it more efficient to work with an IDNO to ultimately connect their power to consumers.

In addition, in March 2024 the U.K.’s ESO announced a plan to invest £58 billion to expand and upgrade its transmission system to meet growing demand for energy and facilitate the transition to a low-carbon economy.25 The plan centers on adding an additional 21 GW to the grid from offshore wind farms in the North Sea off the coast of Scotland—another example of the investment and planning needed to connect distant renewable energy generation to where consumers live.

Clearly, many steps and much private investment will be needed to transition the world to a net-zero economy, as well as meet growing demand for power.