Scope One

Direct greenhouse gas (GHG) emissions from sources owned or controlled by the reporting company; for example, emissions from combustion in boilers, furnaces or vehicles.

Our ambition is to achieve net zero emissions by 2050 across the assets we manage.

Direct greenhouse gas (GHG) emissions from sources owned or controlled by the reporting company; for example, emissions from combustion in boilers, furnaces or vehicles.

Indirect GHG emissions from the generation of purchased or acquired electricity, steam, heating or cooling consumed by the reporting company.

Indirect emissions that occur in the value chain (both upstream and downstream) not controlled by the reporting company.

We have been assessing our corporate operations and controlled portfolio companies’ emissions for several years. Our focus is on measuring the emissions of our controlled portfolio companies, where we believe we can drive the widest impact. We believe that the global focus on high-quality scope 1 and 2 emissions data will help with efforts across scope 3. We have also begun reporting scope 1 and 2 emissions of our non-controlled investments (financed emissions).

We invested in a developer of technologically advanced carbon capture and sequestration, which we believe can play a meaningful role in decarbonizing carbon-intensive sectors.

As climate change reshapes the modular services and infrastructure industry, we continue to support our portfolio companies endeavoring to be leaders in the circular economy.

Investing in businesses that support customer objectives and contribute to local climate action plans.

Many corporate tenants have made their own net zero commitments, necessitating addressing office occupancy emissions. Brookfield can take an outsized role in delivering solutions.

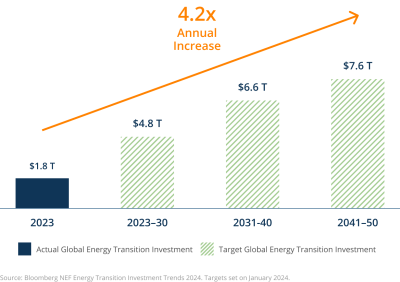

Achieving net zero by 2050 is estimated to require a 4x increase of annual investments into energy transition and renewable asset classes by 2050.

Across our businesses—Renewable Power & Transition, Infrastructure, Private Equity, Real Estate and Credit—we are mobilizing capital to facilitate a transition to a lower-carbon economy.

We have deployed capital into “Climate Solutions,” or assets that directly remove or reduce real-economy GHG emissions, and “Climate Enablers,” assets that indirectly contribute to, but are necessary for, emissions reductions by facilitating the deployment and scaling of Climate Solutions or supporting the decarbonization of other actors’ operations.³

Our Renewable Power & Transition business is one of the world’s largest investors, developers, owners, and operators of clean power and decarbonization assets.

³ GFANZ “Scaling Transition Finance and Real-Economy Decarbonization;” December 2023; https://assets.bbhub.io/company/sites/63/2023/11/Transition-Finance-and-Real-Economy-Decarbonization-December-2023.pdf page 20.

⁴ Source: Based on Brookfield’s internal analysis, leveraging emissions factors from the IFI Harmonised and 2022 GHG Emissions data from the French Ministry of the Energy Transition.

For a more detailed overview of Brookfield’s sustainability strategy and approach, please visit our 2023 Sustainability Report.

For more information on Brookfield Corporation's sustainability progress, please click here.