Introduction

Private credit has grown rapidly in recent years, as investors stepped in to fill the gap created when traditional banks retreated amid more stringent regulation after the financial crisis of 2008. The fundamental shift in rates—from an extended period of declining rates to higher for longer—has created an attractive opportunity to allocate to private credit. Investors have taken note, with the asset class now totaling about $1.7 trillion, outpacing the roughly $1.4 trillion of leveraged loans and about $1.3 trillion in high yield bonds1 amid a rise in yields since 2021.

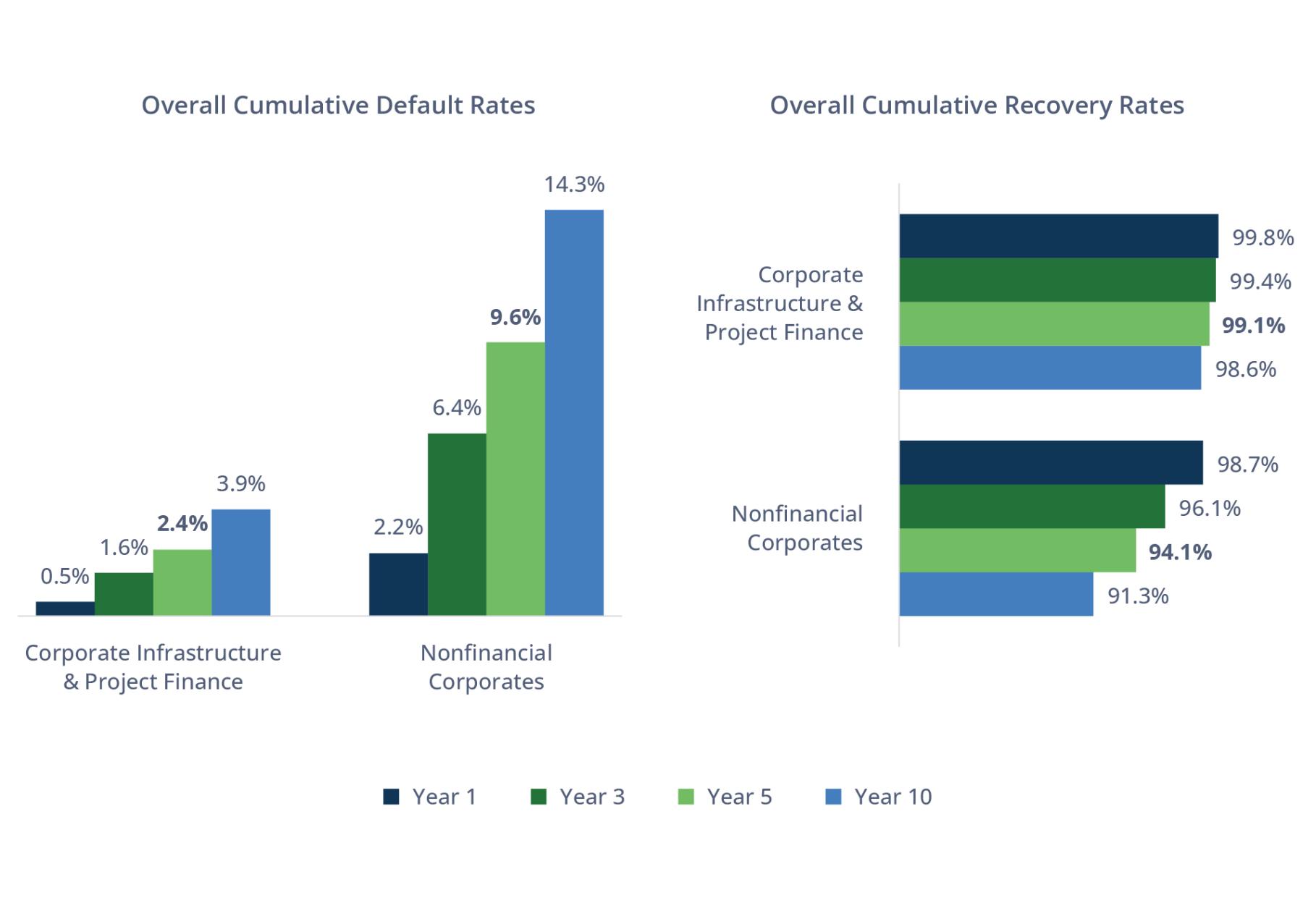

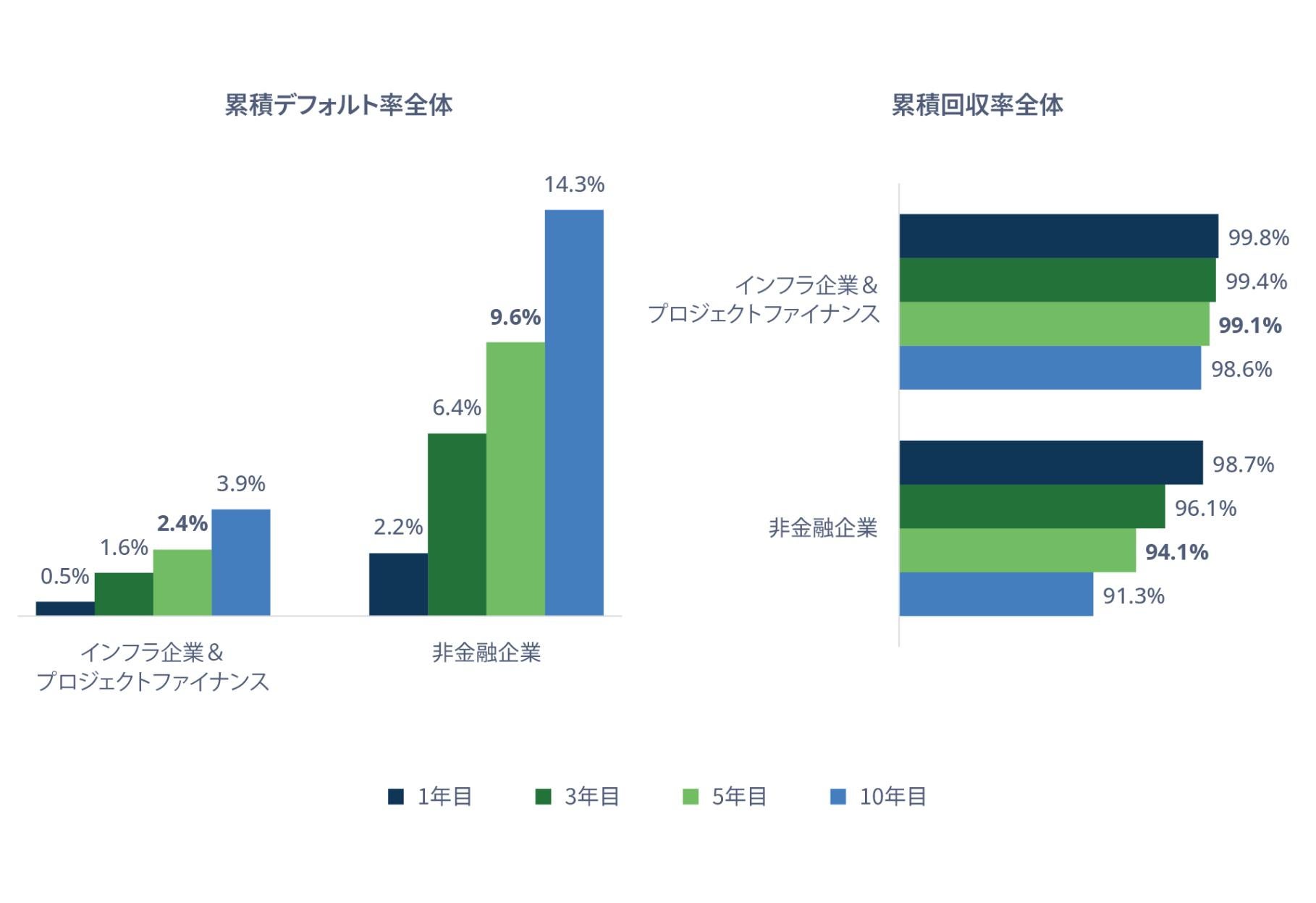

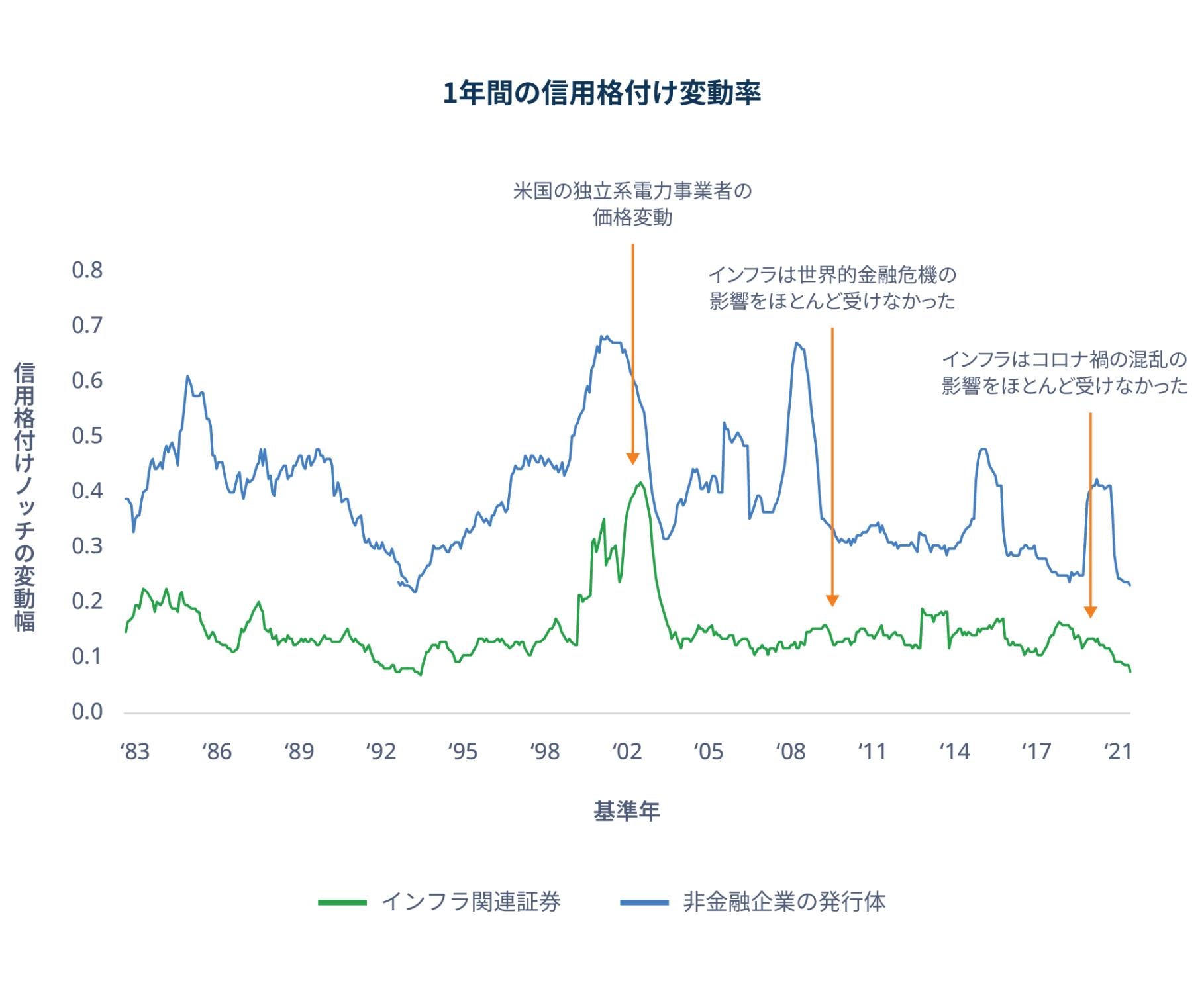

For investors looking to reap private credit’s potential benefits of attractive income generation, inflation mitigation, lower volatility and asset-liability matching, we believe that infrastructure debt is a compelling choice. It offers the potential for attractive risk-adjusted returns with significant potential downside mitigation, as well as diversification benefits. Infrastructure debt also benefits from the unique characteristics of infrastructure assets, particularly those providing essential services in markets with high barriers to entry and consistent cash flows.

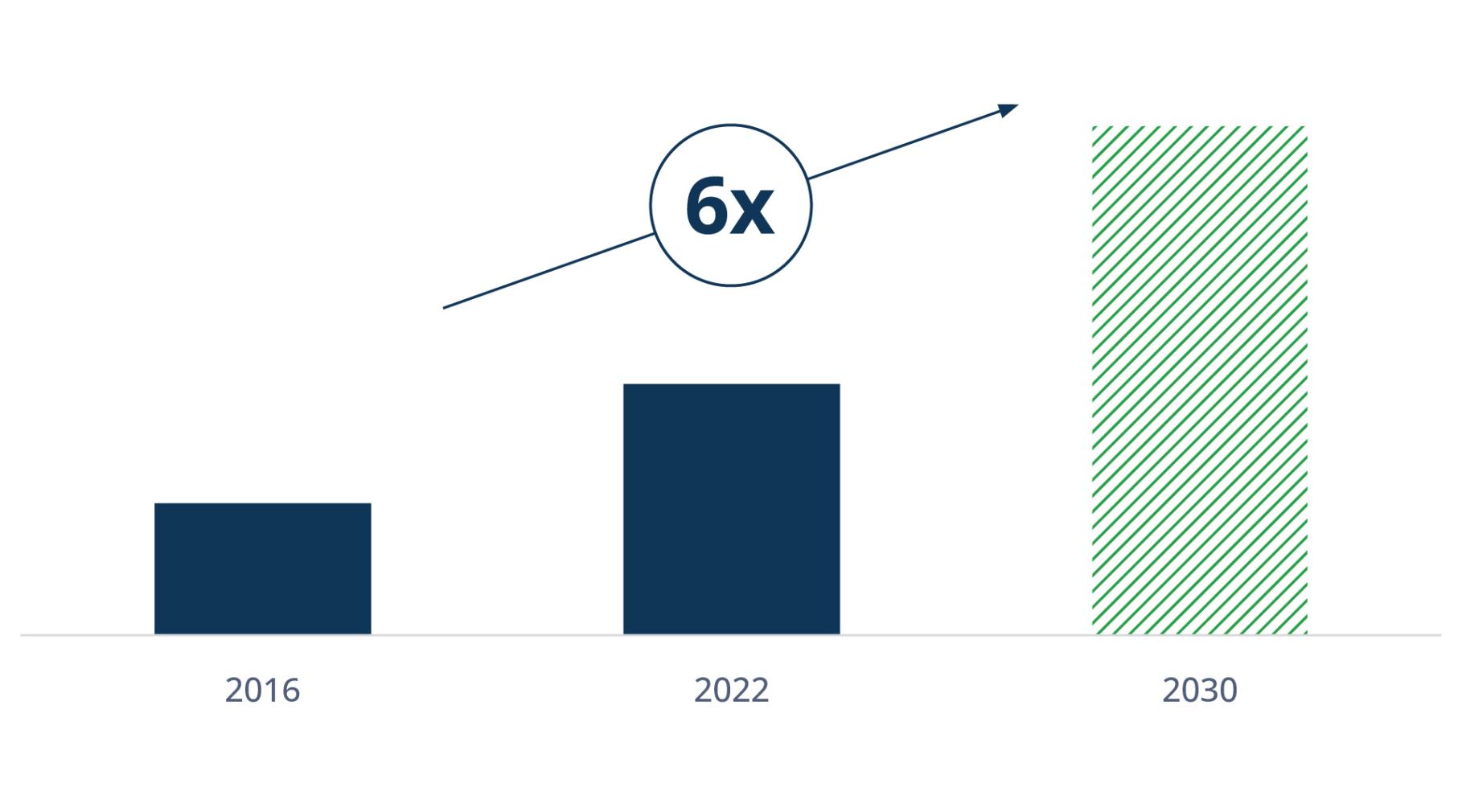

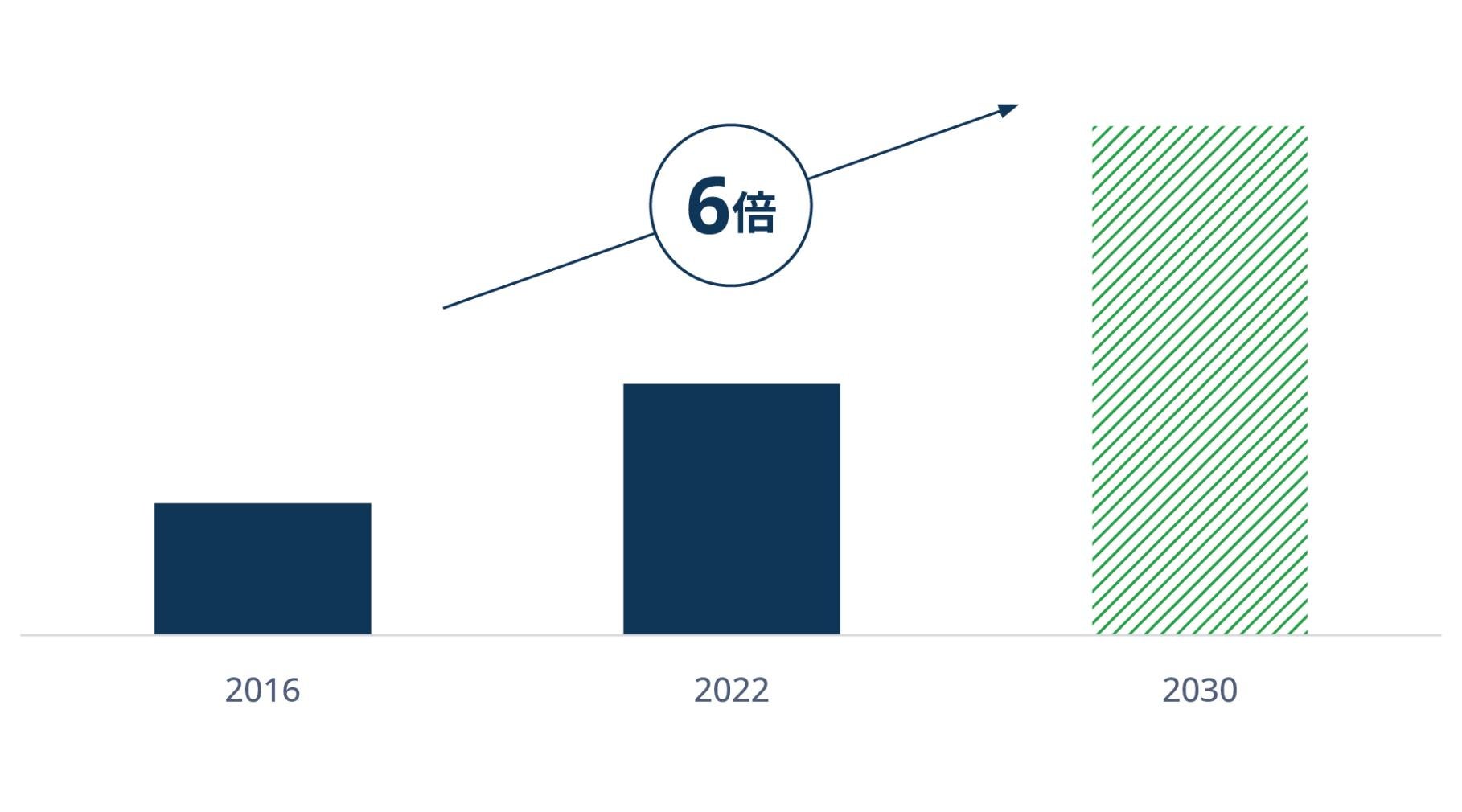

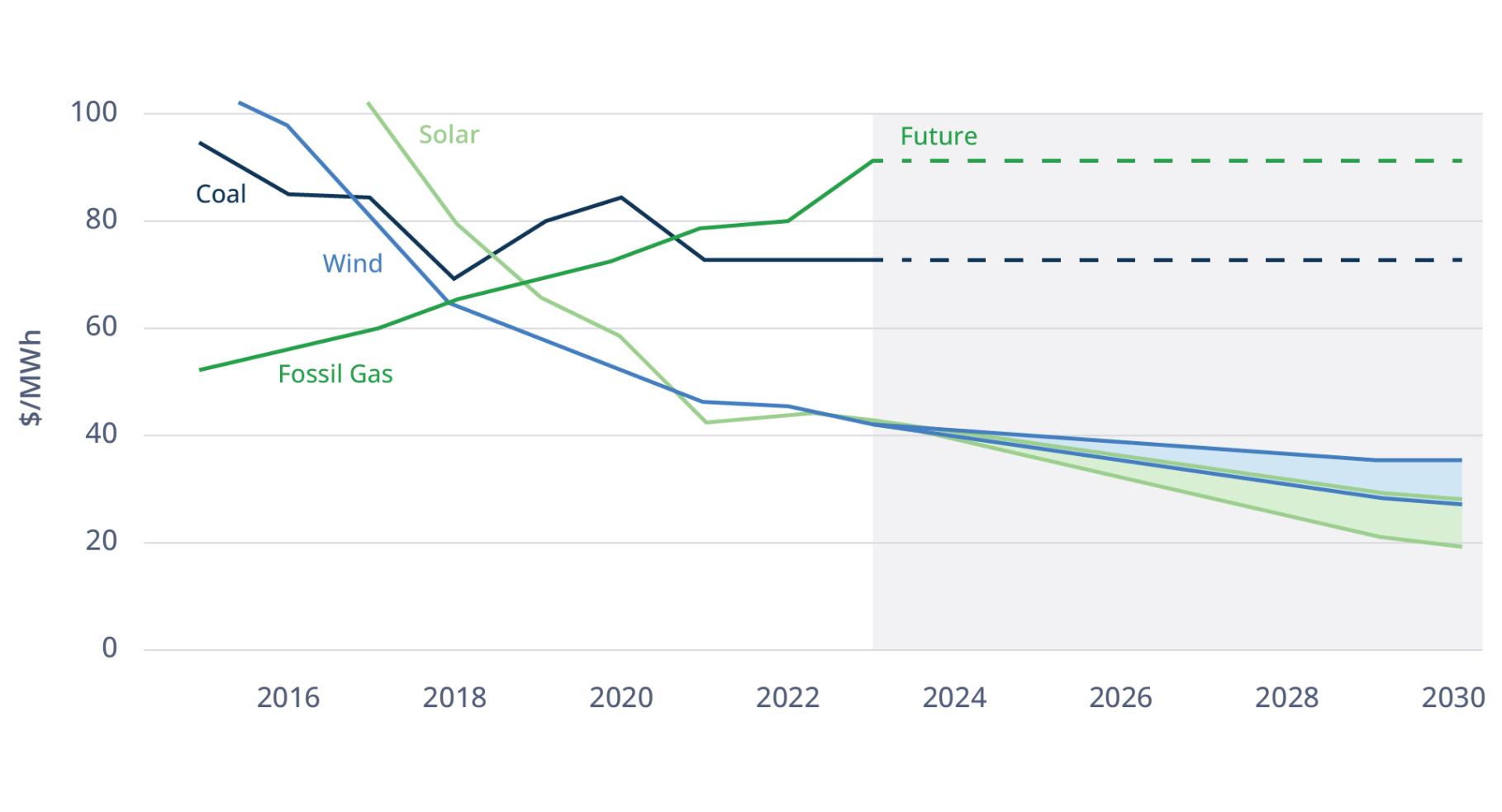

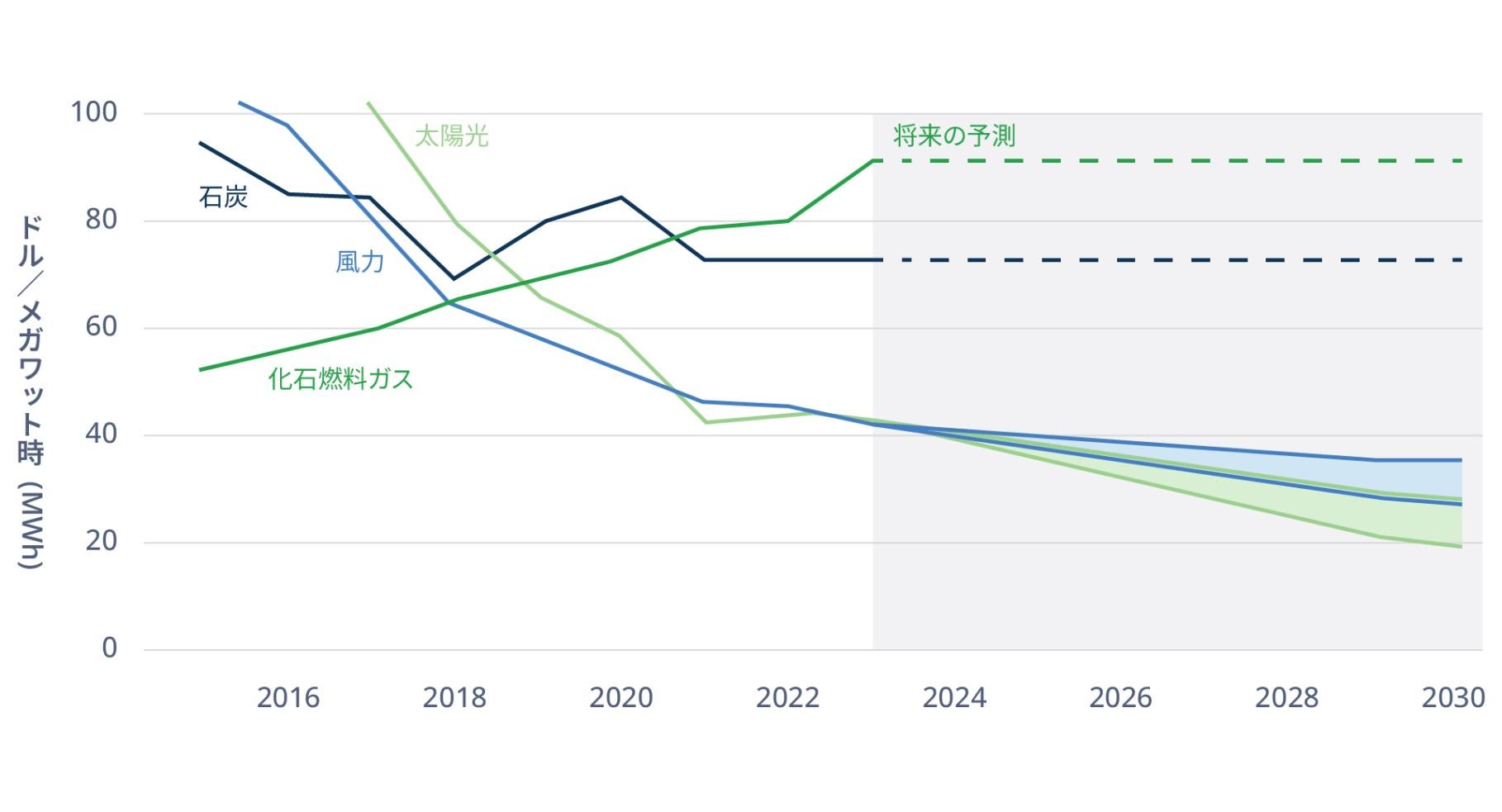

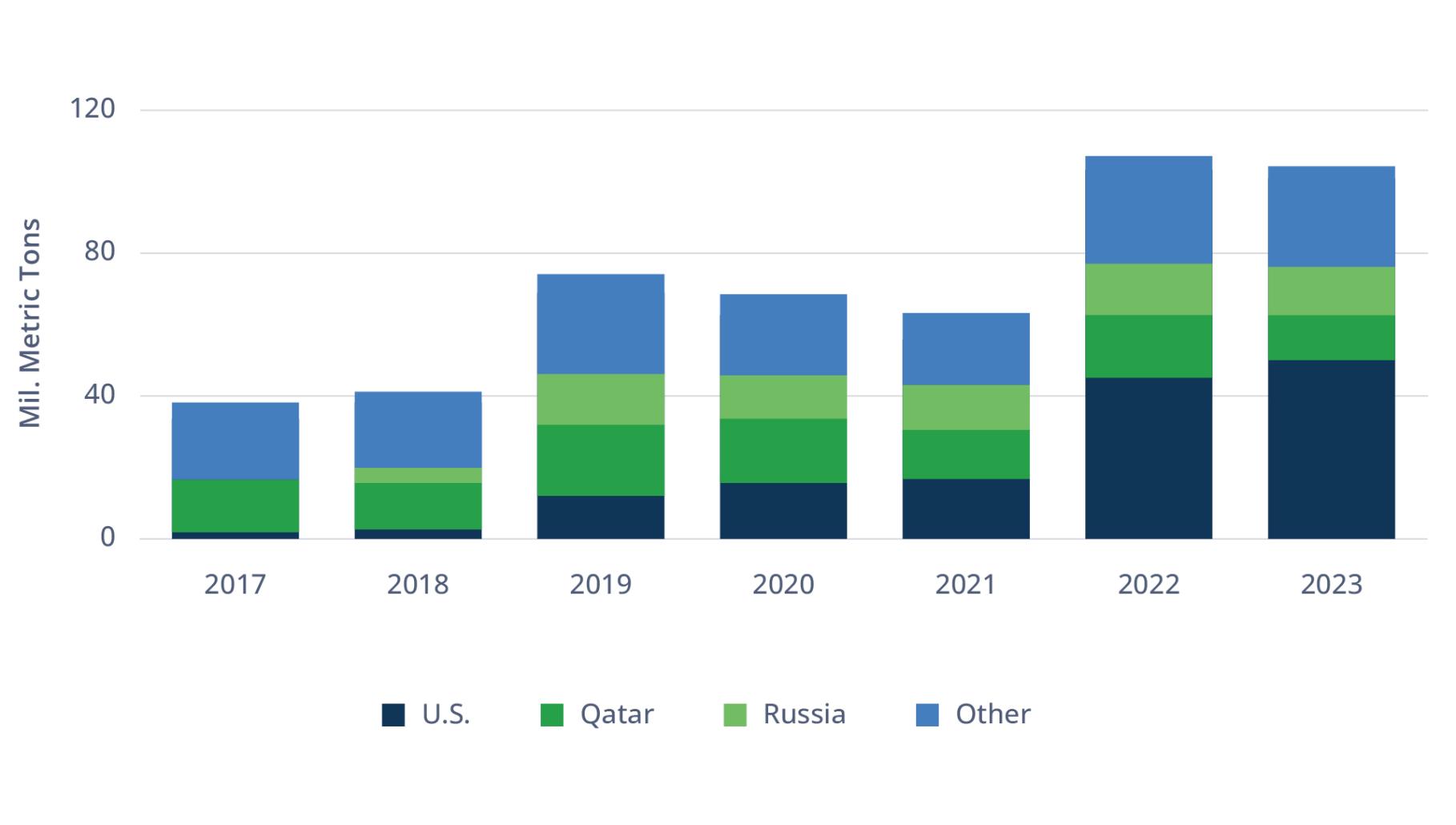

In addition, infrastructure debt stands to benefit from tailwinds to infrastructure growth—what we call the “Three Ds”—of digitalization, decarbonization and deglobalization, along with rising fiscal support and strong corporate demand for clean power. Brookfield estimates that these megatrends will drive an infrastructure supercycle to the tune of $200 trillion in investment over the next 30 years. With infrastructure and renewable assets typically financed 50%-70% debt to cost, we expect a significant share of this capital deployment opportunity to be in debt.