Capturing the Benefits of Infrastructure Debt

Infrastructure debt is a compelling asset class within private credit, combining the potential for attractive returns and diversification.

Key Takeaways

- Private credit has grown into a mature asset class totaling about $1.7 trillion.

- Infrastructure debt stands out among private credit, offering significant downside mitigation and the potential for attractive risk-adjusted returns and diversification benefits.

- Infrastructure serves as the backbone of the global economy, providing essential services including the transportation and storage of goods, water, energy, people and data.

- Brookfield believes that three megatrends—digitalization, decarbonization, and deglobalization—will drive an infrastructure supercycle with the need for $200 trillion in investment over the next 30 years. A large share of the capital deployment opportunity to fund these “Three Ds” will be in infrastructure debt, in our view.

Introduction

Private credit has grown rapidly in recent years, as investors stepped in to fill the gap created when traditional banks retreated amid more stringent regulation after the financial crisis of 2008. The fundamental shift in rates—from an extended period of declining rates to higher for longer—has created an attractive opportunity to allocate to private credit. Investors have taken note, with the asset class now totaling about $1.7 trillion, outpacing the roughly $1.4 trillion of leveraged loans and about $1.3 trillion in high yield bonds1 amid a rise in yields since 2021.

For investors looking to reap private credit’s potential benefits of attractive income generation, inflation mitigation, lower volatility and asset-liability matching, we believe that infrastructure debt is a compelling choice. It offers the potential for attractive risk-adjusted returns with significant potential downside mitigation, as well as diversification benefits. Infrastructure debt also benefits from the unique characteristics of infrastructure assets, particularly those providing essential services in markets with high barriers to entry and consistent cash flows.

In addition, infrastructure debt stands to benefit from tailwinds to infrastructure growth—what we call the “Three Ds”—of digitalization, decarbonization and deglobalization, along with rising fiscal support and strong corporate demand for clean power. Brookfield estimates that these megatrends will drive an infrastructure supercycle to the tune of $200 trillion in investment over the next 30 years. With infrastructure and renewable assets typically financed 50%–70% debt to cost, we expect a significant share of this capital deployment opportunity to be in debt.

Infrastructure Debt Offers Compelling Characteristics

Infrastructure assets form the backbone of the modern economy. They include the networks and systems that provide essential services and facilitate economic activity, and they tend to involve the movement or storage of goods, water, energy, people or data. Examples of these assets include toll roads, bridges, airports, power lines, solar and wind farms, communication towers, data centers and much more.

Owners of infrastructure assets typically have high up-front investment costs and navigate a complex regulatory environment to develop, maintain and upgrade their assets over time. Their needs as borrowers vary, ranging from financing of capital expenditures and acquisition finance to refinancings and recapitalizations.

Infrastructure debt has unique characteristics stemming from the nature of those structures and services:

- They are essential. Infrastructure assets generally serve as the backbone for basic, irreplaceable public services that support economic and social activity. As a result, these infrastructure assets benefit from relatively inelastic demand.

- They have high barriers to entry. Due to high capital costs, geographic location advantages and contractual and/or regulatory frameworks, infrastructure assets typically have high barriers to entry and often face little or no competition.

- They generate sustainable long-term cash flows. The regulatory framework or concessions that infrastructure services are provided under tend to last for more than 30 years, with pricing provisions aimed at generating a predictable return over time. This can help support asset-liability matching in a portfolio.

- Their revenues are linked to inflation. Cash flows produced by infrastructure assets are commonly linked to measures of economic growth, such as inflation. In some cases, revenue increases due to inflation are embedded in concession agreements, licenses and contracts. In other instances, due to the essential nature and inelastic demand of infrastructure assets, owners can pass inflation on to consumers through price increases.

- They have high operating margins and predictable maintenance capital requirements. Infrastructure assets are generally highly capital intensive, with relatively predictable operating and maintenance expenses. Due to relatively low ongoing variable costs, these assets typically exhibit high operating margins once commissioned.

Other advantages can also be built in at the loan level. For instance, they can be structured to include liens and to limit the incurrence of additional debt, asset sales and investments, and changes of control. Covenants can be built in with the aim of providing early detection of credit weakness, such as maximum leverage covenants and restrictions on distributions. Additionally, step-in rights can be included that can provide the ability to take ownership of an asset with a view to maximizing recovery proceeds in the event of any distress.

All of these characteristics mean that infrastructure debt can potentially provide diversification benefits to investment portfolios and attractive risk-adjusted returns. Indeed, it often offers a premium over loans made to similarly rated corporates, while providing exposure to investments that are deemed to be essential in nature.

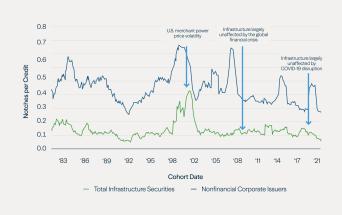

Infrastructure debt also tends to have a lower incidence of default, higher recovery rates and lower rating volatility compared with nonfinancial corporates, according to a Moody’s analysis (see Figures 1 and 2).2 The cumulative five-year default rate for nonfinancial corporates has been 9.6%, while infrastructure corporate and project finance has been 2.4%.3

Figure 1: Infrastructure Debt Has Relatively Low Default Rates …

Source: Moody’s "Infrastructure Default and Recovery Rates, 1983-2022"

Figure 2: … And Low Rating Volatility

One-Year Rating Volatility

Opportunities in Private Infrastructure Debt

We have seen increasing demand from infrastructure borrowers looking for a wide range of private debt solutions, such as:

- Funding to support growth. For new projects, private infrastructure debt can help optimize a sponsor’s cost of capital, enhancing project viability and/or the sponsor’s overall competitiveness. It can also allow a sponsor to do more with less equity capital, accelerating their growth potential.

- Acquisition financing. In asset acquisition scenarios, private infrastructure debt can decrease a bidder’s cost of capital by reducing the amount of equity needed—enhancing the bidder’s competitiveness and/or enabling a sponsor to acquire a larger asset than would otherwise be possible.

- Sponsor recapitalization. For existing infrastructure asset owners, private infrastructure debt can release capital for distributions and/or reinvestment toward new projects without a loss of ownership or control.

- Refinancing transactions. Private infrastructure debt can be used to refinance existing debt approaching maturity or restore leverage to investment grade levels.

Depending on their risk appetite, investors can choose to invest in senior and/or subordinated loans. Both benefit from the same stable underlying assets and attractive relative value in relation to similarly rated corporates.

As their name suggests, senior debt is placed first in the capital structure—or the layers of capital that are used to finance an infrastructure investment. The senior layer is prioritized in the “payment waterfall,” meaning the senior debtholders are paid before subordinated and equity holders.

While subordinated debt is lower in the capital structure, it generates a higher yield potential and still benefits from a significant equity cushion. The number and scale of market participants focused on this component of the capital structure is limited—providing potentially attractive competitive dynamics.

Riding Infrastructure’s Tailwinds

While private credit and infrastructure debt have both benefited in the period since the global financial crisis, several tailwinds are accelerating to create a supercycle that we expect will make infrastructure debt even more attractive over the long term. Large-scale capital is required to fund the expected $200 trillion in investment that will be made over the next 30 years. These investments will span the “Three Ds”—digitalization, decarbonization and deglobalization (see Figure 3).

Figure 3: The Three Ds Driving Infrastructure Investment

Source: Brookfield internal research.

Digitalization

The worldwide proliferation of data is resulting in wide-ranging investment opportunities in infrastructure, in our view. These include the need to upgrade networks from copper to fiber to support faster speeds, more bandwidth and lower latency. There is also a need for additional infrastructure to support the rollout of 5G and new wireless solutions, such as new cell towers.

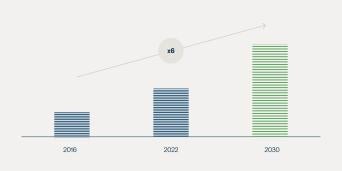

Demand for cloud-based services continues to expand rapidly, with global spending forecast to grow at nearly a 20% compound annual growth rate, reaching more than $1.3 trillion in 2027.4 In addition, artificial intelligence (AI) is supercharging the need for power and digital capacity (see Figure 4). For example, a ChatGPT query needs nearly 10 times as much electricity to process as a Google search.5 The global AI infrastructure market—including software, hardware and data centers—should expand at a compound annual growth rate of 43.5% through 2029 to reach $422.55 billion, up from $23.5 billion in 2021.6

Figure 4: More and Larger Data Centers Need More Renewable Power

U.S. Data Center Power Consumption (GW)

Source: McKinsey, “Investing in the rising data center economy,” January 17, 2023.

Decarbonization

With the global urgency to decarbonize, many governments and companies are setting the goal of net-zero emissions by 2050. Yet global investment in clean energy needs to rise to around $4.5 trillion per year by the early 2030s to get there, up from about $1.8 trillion in 2023.7

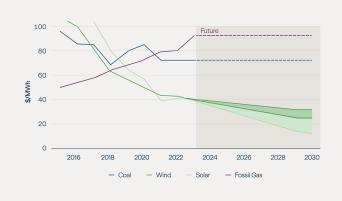

This is resulting in an outsized market opportunity in renewable energy sources. What’s more, the cost of renewable energy—particularly solar and wind—has dropped dramatically in recent years and is now lower than fossil-fuel generation in most markets (see Figure 5).

Figure 5: Renewables Are Expected to Keep Beating Fossil Fuels on Cost

Note: Shown is the levelized cost of energy, or a power plant’s lifetime costs divided by its energy production ($/MWh). Source: BNEF, RMI, Canary Media, 2023.

Strong corporate demand is driving investment in renewable energy projects globally. According to BloombergNEF, corporate clean power purchases grew 12% to a new record in 2023.8

While investment in renewable energy is growing fast, an important—and often overlooked—factor is the need to connect all these new clean energy sources to the electricity grid and deliver it to the end consumer. Future projects are likely to face resistance until substantial investment is made in expanding and improving power infrastructure globally. In their current state, the world’s power grids cannot handle the massive buildout of renewable power needed to reach net zero and meet growing demand for electricity. More than 40% of grids in advanced economies are more than 20 years old, or in the second half of their lifespans, with some grid infrastructure dating back 50 years or more.9

Transforming global power grids will require nearly a two-fold increase in transmission investment by 2030—to more than $600 billion annually.10 Utilities generally don't have the budget for that level of investment and thus stand to benefit if capital—including debt—from other sources is directed to grid expansions and upgrades.

Deglobalization and energy security

Deglobalization trends have taken hold following the global supply chain disruption during the global pandemic. And recent geopolitical events in Europe have highlighted the importance of energy security.

For example, the U.S. Inflation Reduction Act provides an estimated $370 billion of financial incentives over the next decade to ensure national energy security as well as accelerate the transition to a clean energy economy.

Many countries and companies are also looking to “reshore” their essential and strategic manufacturing processes and supply chains. In the U.S., the U.S. CHIPS and Science Act provides $280 billion in funding to spur investments in domestic semiconductor manufacturing capacity as well as R&D and commercialization of leading technologies such as AI, quantum computing, clean energy and nanotechnology.

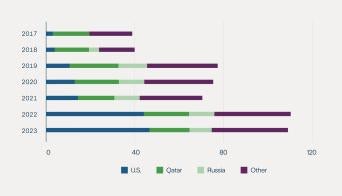

Last but not least, geopolitical events have also highlighted the need for natural gas in an energy-security-conscious future. This has become especially evident in Western Europe, which in recent years has increasingly relied on natural gas imports from the U.S. over Russia (see Figure 6). Investment will be needed in critically located infrastructure for the continued processing, transportation and distribution of this commodity.

Figure 6: U.S. Accounted for Almost Half of Europe’s LNG Imports in 2023

Note: Data is for Western Europe. Source: Bloomberg.

Investing in Infrastructure Debt

Infrastructure debt is attracting more and more investors for good reason. While we see this as a positive trend, when underwriting debt or structured equity, it’s important for investors to consider barriers to entry, growth and capex plans, credit quality, refinancing risk, and the potential for downside mitigation.

Although infrastructure assets have similar characteristics, they vary greatly across sectors. For example, the risk profile of a wind farm with a 20-year power purchase agreement can be much different than that of a container terminal within a port. Similarly, a thorough understanding of regulatory regimes is vital because cash flows are often derived from regulated sources.

Because of these complexities, specialized knowledge is required to effectively conduct thorough due diligence, manage risk and ensure downside mitigation in the event of a credit event. To properly underwrite and structure a transaction, a deep understanding of how these assets operate and the regions in which they operate is critical.

Additionally, within subordinated credit, there is typically less competition from traditional lenders. Lenders in this space, therefore, tend to hold more bargaining power when laying out the terms of these deals and typically structure them with very strong covenant packages.

In addition to deep credit expertise, investors can benefit from partnering with managers who are able to deploy significant capital, which can reduce competition, as well as a local presence in the markets they are investing in, which can facilitate direct deal sourcing. In our view, investors who do so will be best positioned to take advantage of the sector’s attractive risk-adjusted returns and diversification benefits, while potentially earning a premium over loans made to similarly rated corporates.

Endnotes:

- U.S. Federal Reserve, “Private Credit: Characteristics and Risks,” February 23, 2024. The Fed cites Preqin for data on private debt.

- Moody’s, “Moody’s Infrastructure Default and Recovery Rates, 1983–2022.”

- Moody’s, “Moody’s Infrastructure Default and Recovery Rates, 1983–2022.”

- International Data Corporation (IDC), “Worldwide Spending on Public Cloud Services is Forecast to Reach $1.35 Trillion in 2027, According to New IDC Spending Guide,” August 29, 2023.

- Goldman Sachs, “AI is poised to drive 160% increase in data center power demand,” May 14, 2024.

- Data Bridge Market Research, “Global Artificial Intelligence (AI) Infrastructure Market – Industry Trends and Forecast to 2029,” May 2022.

- International Energy Agency, “Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach,” 2023 Update.

- BloombergNEF, “1H 2024 US Clean Energy Market Outlook: Moving Past 2030,” May 30, 2024.

- International Energy Agency, “Electricity Grids and Secure Energy Transitions,” October 2023.

- International Energy Agency, October 2023.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, "Brookfield").

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield's perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.