Credit Tailwinds Are Rising

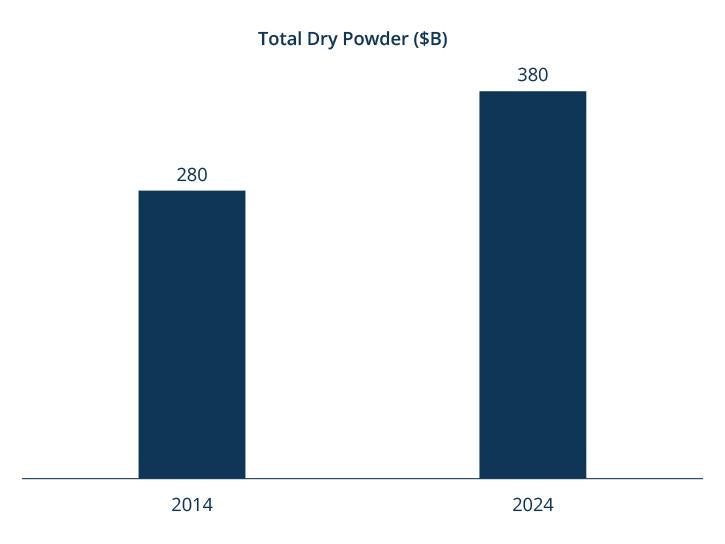

The private credit market is poised to expand further this year, propelled by economic growth, attractive yields, abundant dry powder and increasing regulatory constraints on traditional banks.

Direct lenders are prepared to deploy about $300 billion, while leveraged buyout activity appears ready to build on the momentum from late 2024.2 Mergers and acquisitions (M&A) activity is also expected to increase,3 particularly in the U.S. because of the new administration’s plans to roll back regulation and anti-trust oversight, as well as cut taxes (though uncertainty related to trade policy could have the opposite effect).

The long-term outlook for private credit is even more favorable, in our view, due to both the appeal and evolution of the asset class. As evidenced by the growth of the market over the past decade, we believe that private credit represents a compelling and durable value proposition for both its users (borrowers) and providers (lenders).

The macroeconomic volatility experienced in the post-pandemic environment has raised the profile of private credit solutions for borrowers who value the expediency, flexibility and partnership-oriented approach that has not historically been characteristic of public market financing. Further, we believe private credit offers borrowers greater closing and pricing certainty, especially in times of market dislocation; greater confidentiality, which may be valuable to certain companies wishing to avoid disclosing information to a broad investor base; and customization of deal terms and covenants to meet the unique needs of the borrower or the asset being financed.

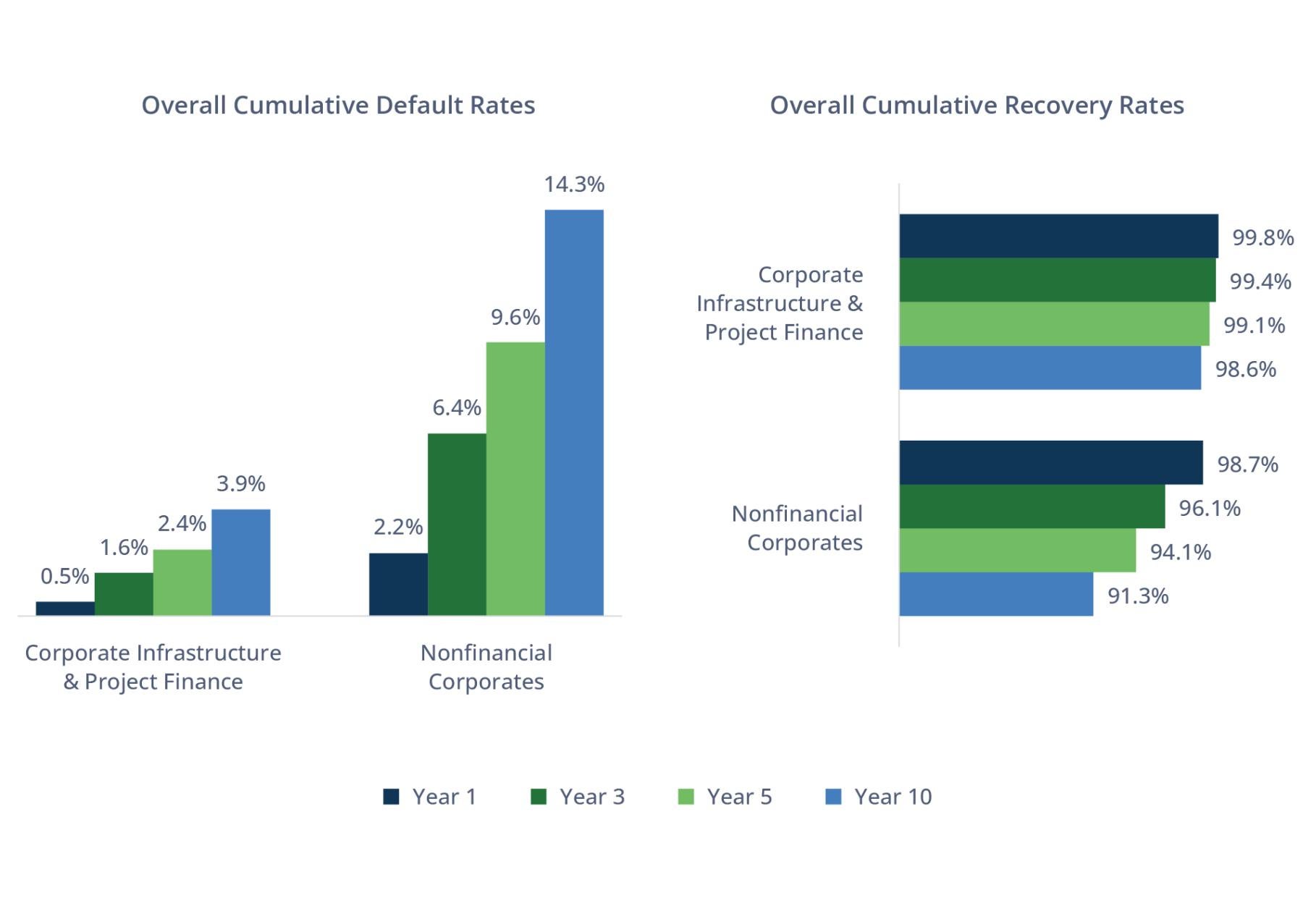

Lenders in private credit markets maintain disciplined fundamental underwriting processes and often enjoy a deeper understanding of the borrowers than traditional lenders. They can also benefit from enhanced returns from illiquidity and complexity premiums, and have the ability to implement structural features to mitigate downside risks in periods of stress.

With such appealing characteristics, the asset class is continuing to evolve. Private credit is best known for corporate direct lending, which has not only dominated the initial evolution of the asset class but has reached maturity, in our view, and may even decline as initial public offering markets open up under the new U.S. administration. We see the next phase of private credit growth concentrated in specialized areas of private credit, including infrastructure, real estate and asset-based finance.