The U.S. multifamily supply forecast has fallen to a 10-year low, with new construction down 36% from its peak.8 Looking ahead, we see rent growth poised to return amid market absorption. Given limited new supply, we see increasing opportunities to renovate existing properties with potentially attractive returns.

We’re also seeing attractive opportunities in the U.S. alternative housing sectors—namely single-family rental, manufactured housing and senior living.

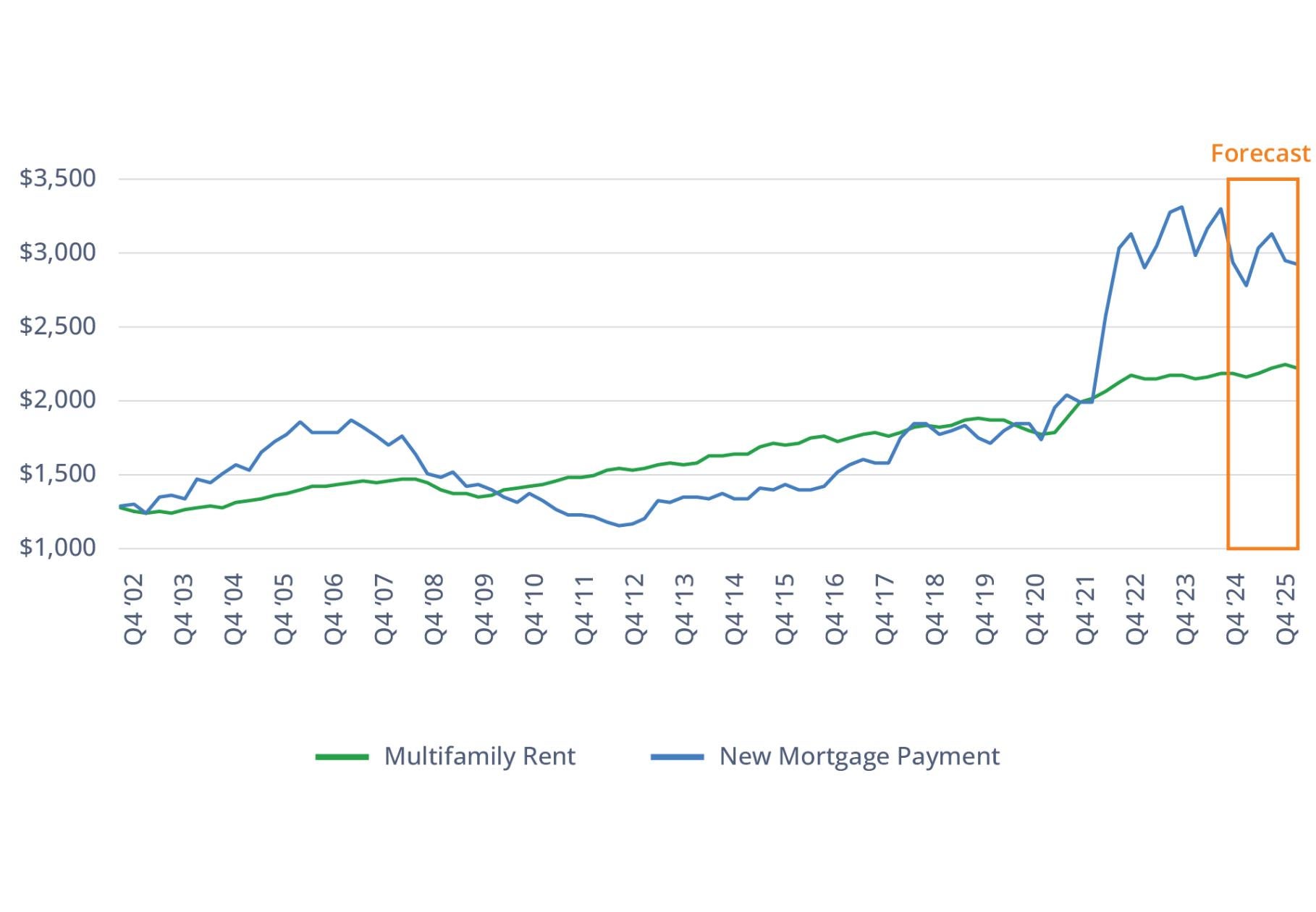

In single-family rental, demographic trends coupled with the elevated cost of home ownership are supporting demand while new supply is limited. This sector is benefiting from the large Millennial population entering their traditional homebuying years. High interest rates and home prices have made renting more affordable than buying. But the supply for single-family rental is also low: The total number of units for sale has dropped each year since 2018, with an estimated shortage of nearly 4 million homes today.9 We’re also anticipating near-term opportunities to purchase unsold single-family rental inventory from distressed homebuilders over the coming year.

In manufactured housing, supply is far from keeping up with demand, largely due to difficult land entitlement and zoning processes. Development of new communities has been essentially nonexistent, and the stock is expected to decline an additional 14% over the next 10 years.10 The lack of institutional ownership in the manufactured housing market provides investors with attractive entry points and the ability to execute cost savings.

Senior housing is also benefiting from long-term demographic trends. By 2030, the U.S. population 80 years and older is expected to increase by more than 4 million to 18.8 million.11 At the same time the ratio of seniors age 80 and over to familial caregivers aged 45–65 will fall by roughly half.12

Yet, once again, supply is low in this sector. Development of senior housing slowed substantially during the pandemic and largely hasn’t recovered. Senior housing construction starts have fallen to just 0.2% of existing inventory, the lowest level in recent history just as demand is starting to grow.13 Building more facilities tends to be cost-prohibitive, so we expect demand for existing stock to rise and support rent growth.

Asia Pacific also offers attractive opportunities in alternative rental housing. Australia and parts of Asia have strong operating fundamentals for student accommodation and senior living. The lack of institutional rental spaces in markets such as India presents a significant opportunity for rental housing projects.

Data centers

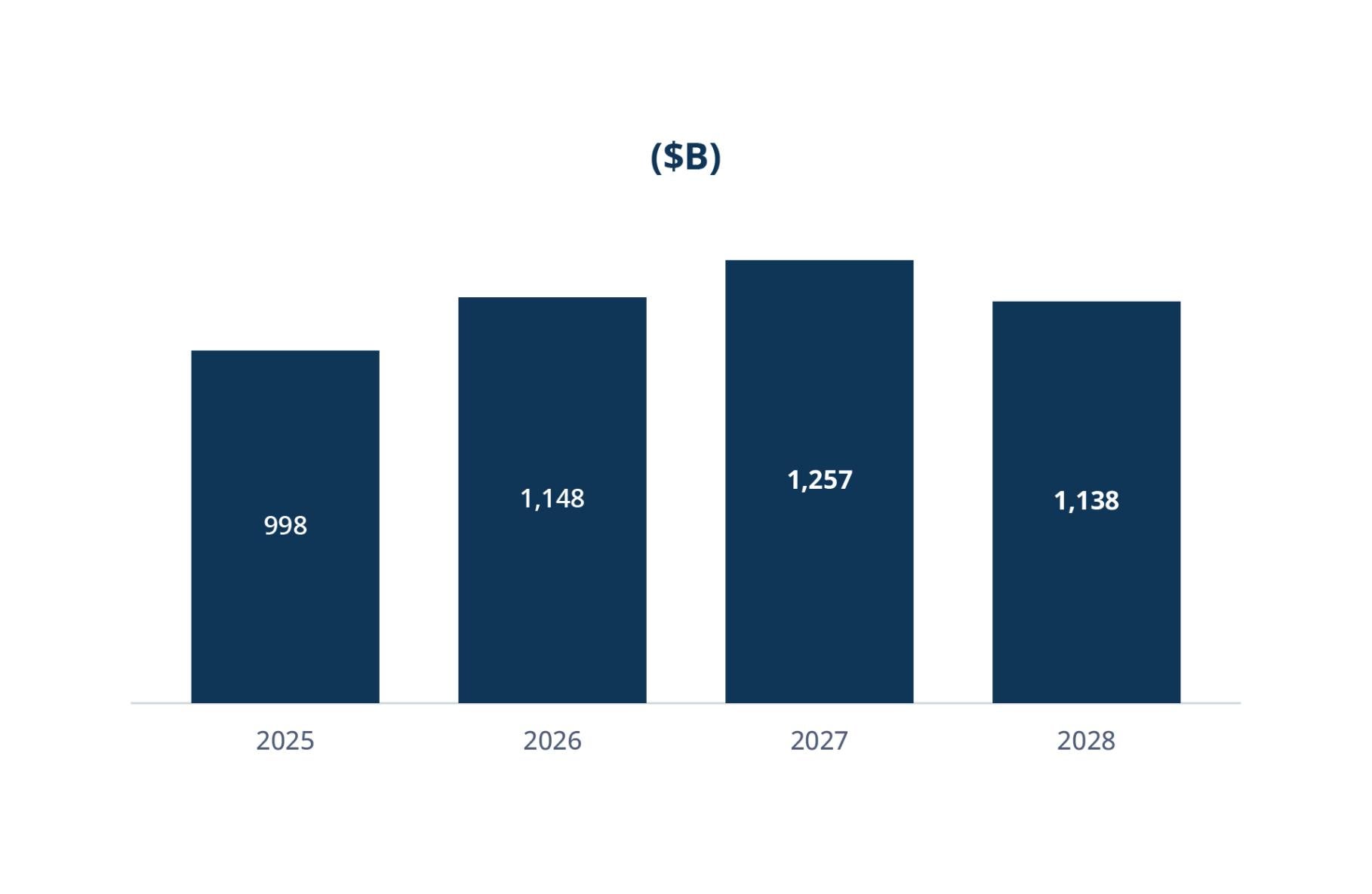

As AI surges to the forefront of the global economy, we see attractive opportunities to capitalize on the explosive demand for data centers that is expected to far exceed supply through 2025 and beyond. Rental rates for these properties have risen, and we expect they will remain strong—despite market speculation around the release of a new AI model from DeepSeek.

The DeepSeek model delivers performance comparable to leading large language models but reportedly was developed at lower cost. While there is rampant market speculation about the effects of this development, we believe that more efficient AI technology could be net positive for the data sector because innovation such as artificial general intelligence and robotics could drive profitability and overall deployment and consumption of AI-related applications. In other words, cheaper AI would likely only increase demand for AI.

As AI models become more efficient and capable, we continue to expect the demand for data centers to grow, particularly for Tier 1 locations that offer maximum flexibility and support multiple use cases.

While the data-center opportunity is global, we are seeing the most robust opportunity set in the U.S. and Europe today. In both regions, land constraints, onerous permitting processes and power-access issues are creating barriers to entry that limit competition. Europe also offers a potentially significant demand source from sovereigns, as many countries are leaning toward building out their own AI infrastructure ecosystem.

We believe that tight supply in the data center sector will benefit developers with on-the-ground resources, and local relationships will give them an advantage in accessing land.

Hospitality

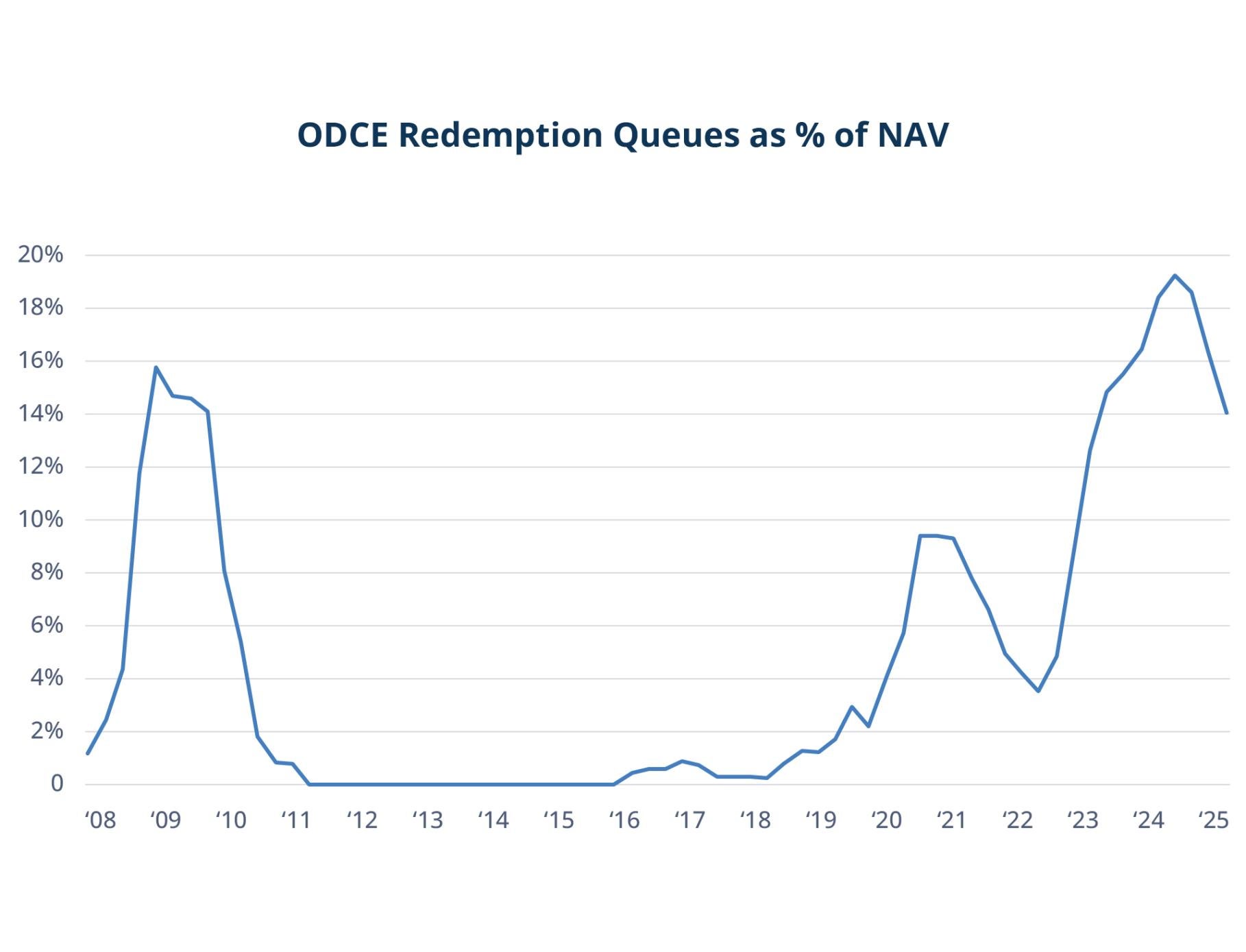

The hospitality sector benefited in recent years from a post-Covid surge in leisure demand. Although that demand is normalizing, group and business travel is picking up. However, similar to other areas of real estate, we see pockets of distress.

Hospitality is a capital-intensive sector, and many assets have been capital-starved amid tight liquidity in the markets. This is opening up opportunities to buy those assets below replacement cost, add value through efficient execution and eventually monetize them.

We see particularly attractive opportunities in Europe, buoyed by U.S. travelers taking advantage of the strong dollar. What’s more, Europe is dominated by independent hotels, many of which are undercapitalized and underinvested due to elevated construction costs and interest rates. As a result, we have found that many of these independent owners are looking to sell, providing opportunities to partner with international brands that are looking to increase their footprint in Europe.

Operational expertise is essential in the hospitality sector. Owning the best assets and allocating capital intelligently is critical for hotel operators to grow their businesses and achieve strong returns.

Logistics

We are finding attractive logistics opportunities for investors who take advantage of market dislocation and acquire high-quality logistics properties at a discount to intrinsic value.

In the U.S., supply has peaked, with new construction slowing. We expect a resilient economy and increasing e-commerce penetration will continue to drive demand for warehouse space. As declining starts drive down vacancy rates, improving pricing power should help stimulate rent growth.

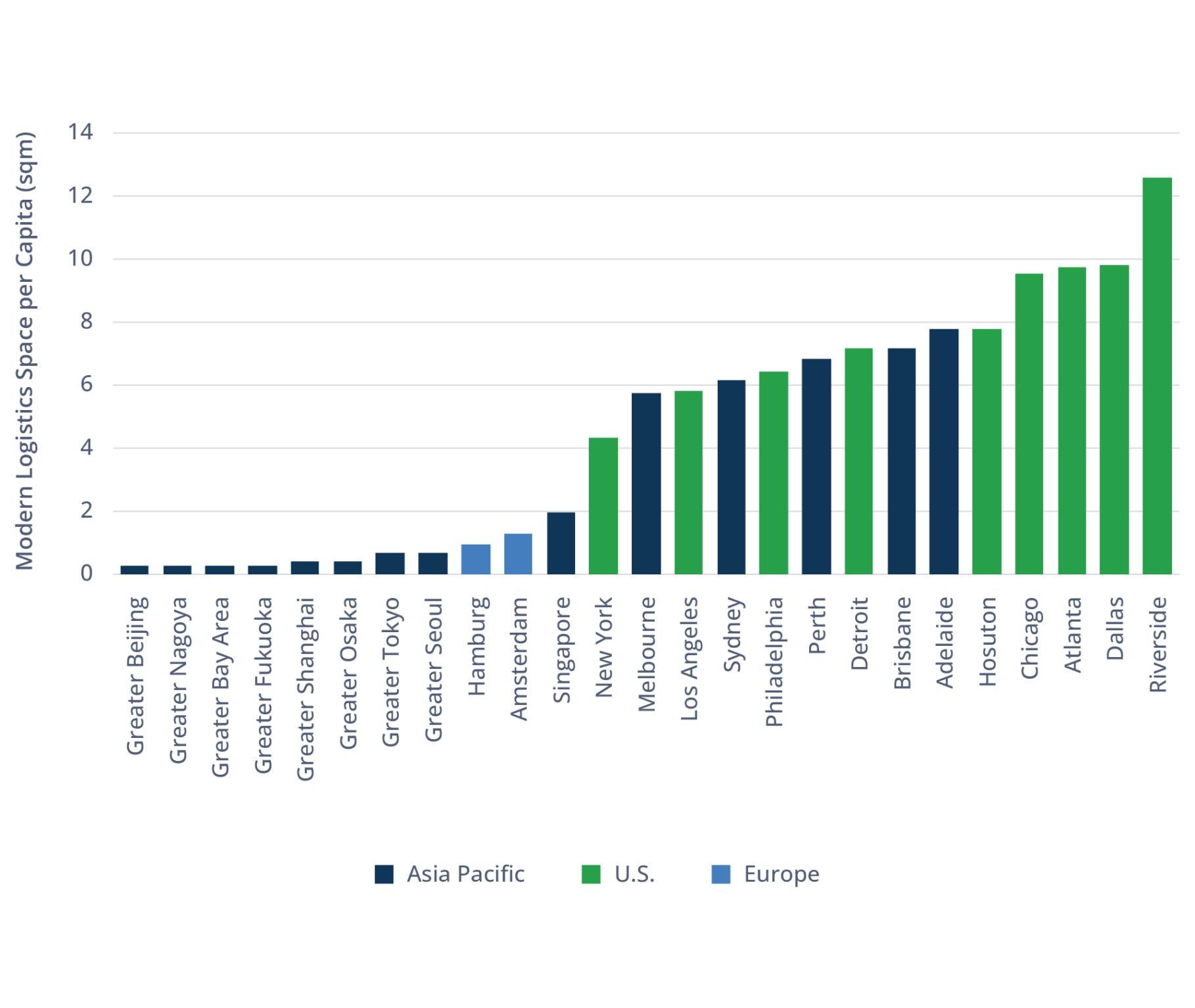

The story is even stronger in Asia Pacific, where the quality of logistics infrastructure in the industrialized countries still has not yet caught up to modern standards (see Figure 5), creating compelling opportunities to renovate and increase rental income properties. For example, in Australia, projected new supply in 2025 is already 40% pre-committed.14 The national vacancy rate is one of the tightest globally at 1.9%, demonstrating the high demand for modern logistics facilities and allowing for meaningful rent growth.15

The investment environment in Asia Pacific is also strong, with a 23% increase in transaction volume in the fourth quarter of 2024 year-over-year.16 Looking ahead, gross domestic product growth in Japan, India and Australia is expected to accelerate in 2025. We expect demand—and rent growth—for logistics to rise along with these expanding economies.