The Macro Picture Shifts But Remains Supportive

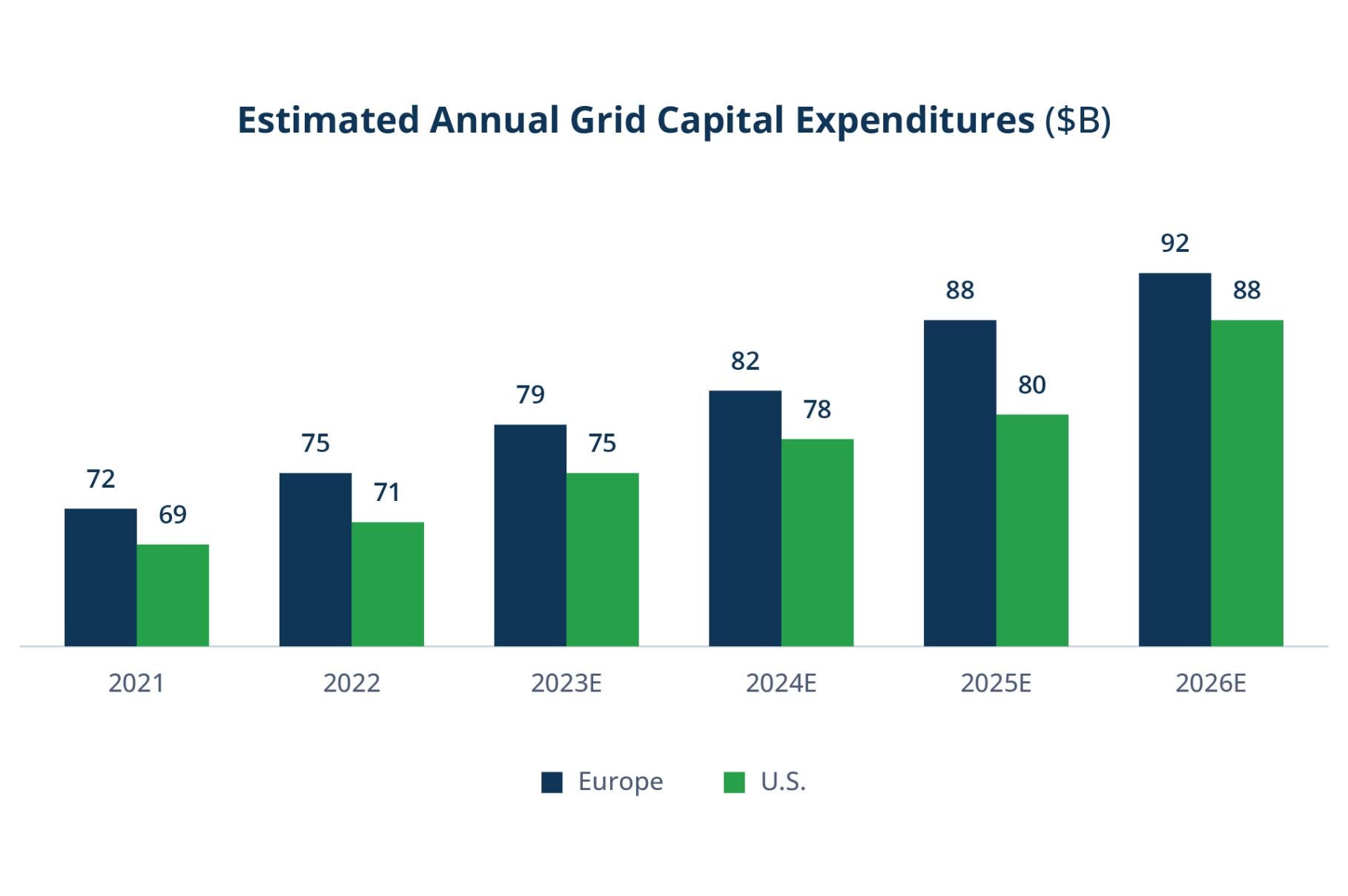

The world needs $94 trillion of capital from 2016 through 2040 to maintain and upgrade legacy infrastructure as well as develop new infrastructure projects like data centers.1 Whether it’s for the pipes and wires that bring gas, electricity or water into your home, or the supply chains moving semiconductor materials, medical equipment and pharmaceuticals around the world, the need for infrastructure investment has never been greater. And governments—many of which are facing budget constraints—won’t be able to do it alone.

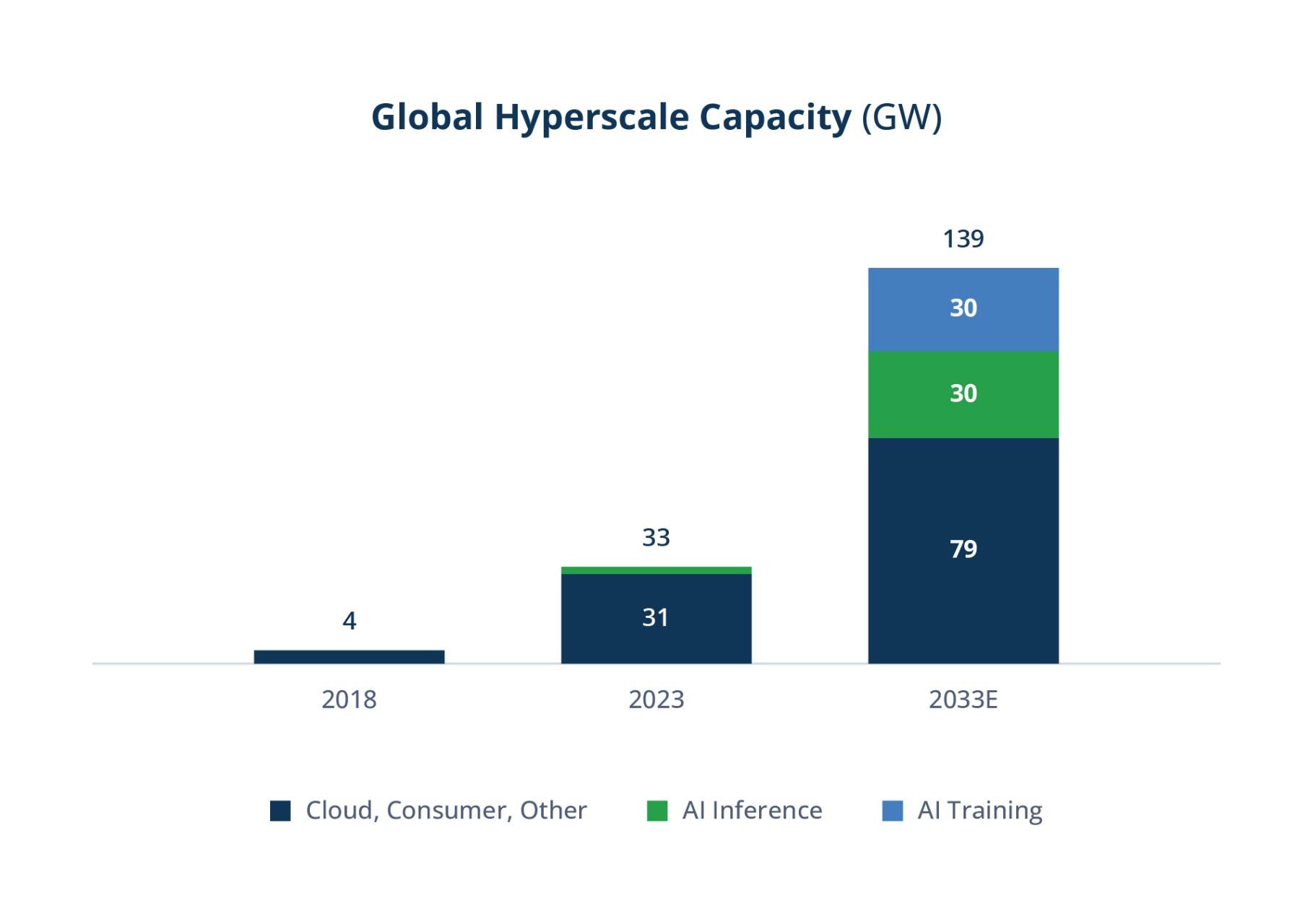

From a policy risk perspective, we expect the “Three D” megatrends of digitalization, decarbonization and deglobalization to continue—regardless of the political environment. Infrastructure historically remains largely insulated from volatility due to the inherent resilience and essential nature of the asset class, which can offer a high degree of long-term contracted or regulated cash flow, inflation indexation, steady dividends and attractive performance throughout market cycles.

In the U.S., across-the-board tariffs could bring higher-than-expected inflation and weaker global growth. Yet, we believe that changes to U.S. trade policy are likely to strengthen the deglobalization trend and benefit certain infrastructure sectors, such as transport. (Generally speaking, infrastructure businesses tend to benefit from higher inflation.) While tariffs are unlikely to have a direct effect on existing infrastructure assets—these are networks that move goods and commodities, not the goods and commodities themselves—they can have an impact on some of our counterparties. If tariffs are prolonged and cause long-term economic uncertainty, this could delay counterparties’ long-term business plans—largely for new-build projects. In this case, managers can ensure that increased capex costs are factored into the pricing on new contracts.

Market speculation is also anticipating changes to the Inflation Reduction Act (IRA), which introduced key policies to encourage clean power and decarbonization efforts in the U.S. While parts of the IRA might be rolled back, we expect some important tax incentives and equity provisions to remain. We do not view a repeal of the legislation as a likely scenario given the significant power supply and demand imbalance in the U.S. It’s also worth noting that the states that have benefited the most from the IRA in terms of jobs and economic development are predominantly led by Republicans.

While the macro, political and industry landscape will continue to shift over time—as it always has—we expect the global infrastructure supercycle to continue unabated. For investors, this trend will generate attractive opportunities to capitalize on over the long term, in our view.