Introduction

Climate change poses unprecedented risks to the global economy—and, of course, to all our livelihoods.

With the United Nations Climate Change Conference (COP26) occurring this November in Glasgow, some countries are ramping up their efforts to combat these risks. The U.K., the host country of COP26, announced a new pledge to reduce carbon1 emissions by 78% by 2035, compared with 1990 levels. Meanwhile, the U.S., which rejoined the Paris climate accord this year, pledged to cut greenhouse gas (GHG) emissions by 50% by 2030, compared with 2005 levels. Lastly, the German government, in response to a ruling by the constitutional court that it was unfairly burdening the younger generation, raised its target for reducing carbon emissions by 2030 from 55% to 65%. It also brought forward its net-zero target by five years—to 2045 from 2050.2

Governments have also been focusing on “green” budgets. The U.K.’s 10-point plan includes big new targets for offshore wind generation, investment in low-carbon hydrogen production capacity, and the introduction of a ban, in 2030, on the sale of new petrol cars.3 And the Biden administration’s proposed $2.3 trillion infrastructure plan includes funding for projects like electric vehicle charging stations and the expansion of transmission lines for wind and solar electricity.4

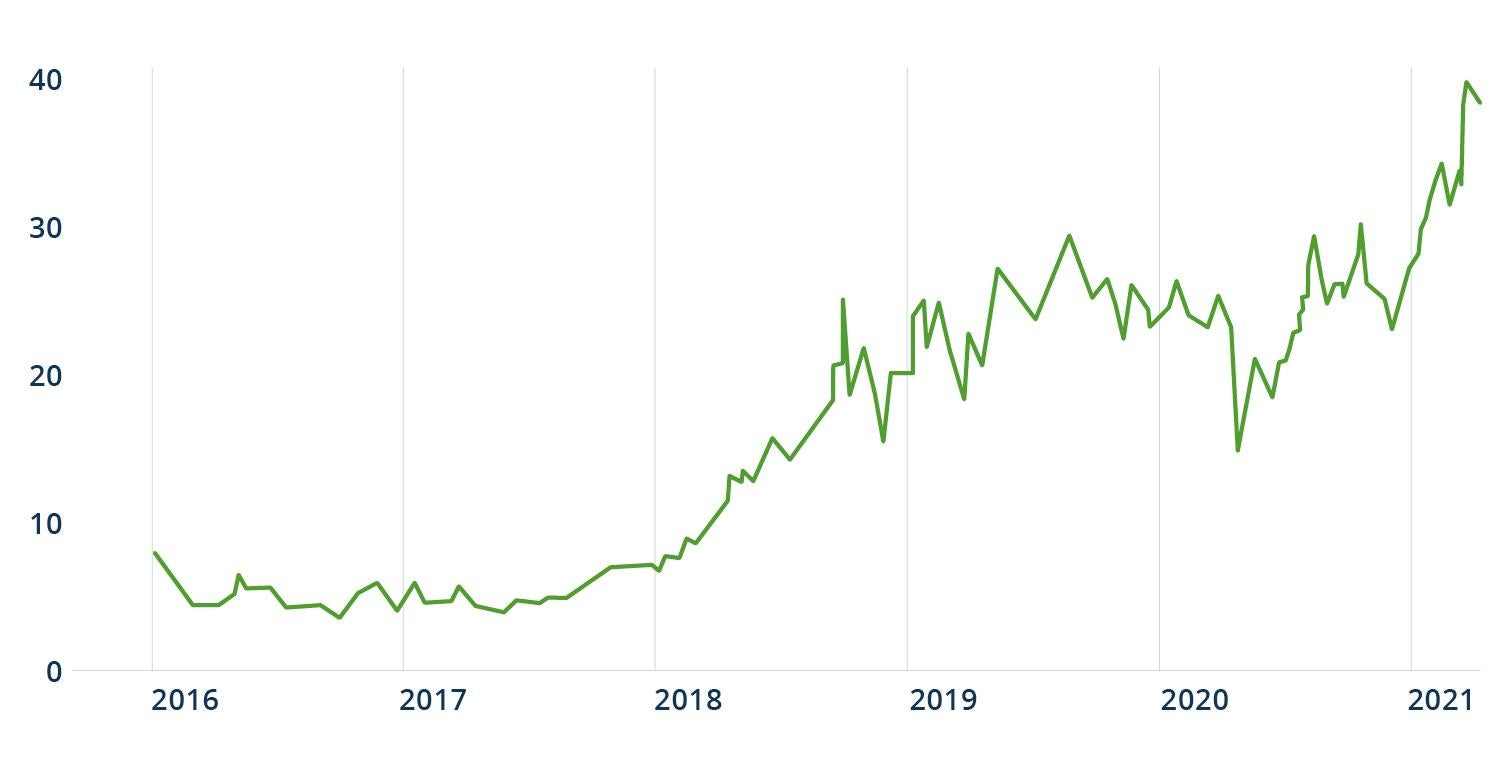

Carbon prices are another policy lever that governments can pull. They create incentives for decarbonization by incorporating the cost of greenhouse gas emissions into the price of goods and services. The result is that companies—and investors—will need to consider the future cost of carbon, since it will lead to changes in the way they allocate capital.5 And carbon pricing has shown to be a powerful tool: Emissions from sectors covered by the EU’s Emissions Trading System are estimated to have fallen by 21% from 2005 to 2020.6

While carbon prices are operational or in the planning stages in many jurisdictions around the world, most of them price carbon at only $40 or less per ton.7 In Canada, however, the government is now legislating a steady increase in the carbon tax such that it reaches C$170 per ton by 2030 from the federal price of C$40 per ton today.8 Overall, governments are making progress, but they still have a long way to go.