Why Infrastructure Is a Compelling Investment for All Cycles

Big trends are driving long-term investment opportunities in high-quality essential assets.

Key Takeaways

- A convergence of global megatrends—digitalization, decarbonization and deglobalization—is shining a spotlight on opportunities to invest in infrastructure, which has demonstrated to be a resilient asset class through market cycles.

- Infrastructure assets can offer a compelling combination of diversification, downside mitigation, inflation protection, income and long duration.

- An allocation to infrastructure may also enable investors to better position their portfolios as they navigate near-term volatility driven by macro factors, such as global geopolitical turmoil, elevated inflation and higher interest rates.

Providing Certainty During Uncertain Times

Infrastructure is critical to the functioning of society, and it’s everywhere. Utilities bring power and water to our homes; ports, ships and containers move our goods; cell towers keep us connected; and data centers power our AI, to name only a few.

Today, several trends are driving long-term investment opportunities in high-quality infrastructure assets. Some of these trends have been around for years, others are relatively new. These are what we call the “Three Ds”: digitalization, decarbonization and deglobalization.

Focusing on infrastructure assets that provide the backbone for essential services allows such investments to support vital economic and social activity. Prominent examples include renewable power generation; electricity transmission and distribution; water distribution; midstream systems; ports, rail and roads; and communication and data networks.

Given their essential nature and dependable revenue streams, these assets often provide investors with diversification, stable income, downside mitigation, long duration and inflation protection, as well as resilient cash flows throughout most economic cycles.

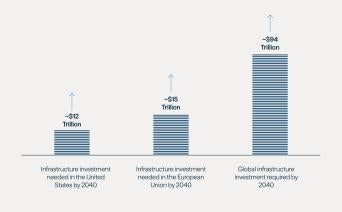

While we believe that infrastructure is compelling for investors in most market conditions, today's investment climate appears to be particularly rife with opportunity—especially considering the global infrastructure funding gap (see Figure 1). On top of available public funds globally, an estimated $500 billion is needed each year by 2030. Private capital is essential to address this gap as governments and corporate asset owners worldwide face budgetary pressures and higher debt burdens. This is forcing many to consider moving some key infrastructure assets off their balance sheets.

Figure 1: The Global Infrastructure Funding Gap

Source: Oxford Economics, “Global Infrastructure Outlook,” August 2023. Represents trends from 2016 to 2040.

Megatrends Support Infrastructure Investment

The Three Ds are driving an infrastructure supercycle, leading to significant investment opportunities over several decades. We estimate that these megatrends will create a $200 trillion investment opportunity over the next 30 years (see Figure 2).

Figure 2: The Three Ds Driving Infrastructure Investment

Source: Brookfield internal research.

Digitalization

Data is the world’s fastest-growing commodity. The total amount of data generated globally doubles every 18 months.1 This data needs to be stored, processed and transferred over wireline and wireless networks for routine consumption, driving demand for storage (data centers) and transmission assets (fiber networks and towers), all requiring significant infrastructure investment.

With the rise of AI, rapid development of related technologies will affect the operations of many critical infrastructure assets and industries. Data centers, for example, will be needed to provide the infrastructure to store and transmit the proliferation of data supporting AI tools. To put this in context, recent analysis shows that a simple ChatGPT query takes three to 36 times more energy than a similar Google search, reinforcing the impact AI innovations will have on one part of the infrastructure value chain.

Digitalization investment opportunities are wide-ranging across the infrastructure universe (see Figure 3). These include the need to upgrade networks from copper to fiber to support faster speeds, more bandwidth and lower latency. An infrastructure buildout is also needed to support the rollout of 5G and new wireless solutions, such as new cell towers, as well as additional data centers to support the migration to the cloud.

Figure 3: Building a New Digital Backbone

Data infrastructure networks require significant upgrades to keep up with rising global demand

Source: Brookfield internal research.

Digitalization is also driving investment opportunities in clean energy, particularly when it comes to powering all those data centers (see Figure 4). Technology companies are seeking to decarbonize their global energy supplies and reduce carbon emissions. As a result, we see significant opportunities to deliver additional renewable energy capacity within the U.S. and Europe, and beyond to Asia Pacific, India and Latin America to support tech companies’ growth aspirations and green energy commitments.

Figure 4: More and Larger Data Centers Need More Renewable Power

U.S. Data Center Power Consumption (GW)

Source: McKinsey, “Investing in the rising data center economy,” January 17, 2023.

Decarbonization

With the global urgency to decarbonize, many governments and companies are setting the goal of net-zero emissions by 2050. Trillions of dollars in investment are needed to get there (see Figure 5). This is resulting in an outsized market opportunity in renewable energy sources. What’s more, the cost of renewable energy—particularly solar and wind—has dropped dramatically in recent years and is now lower than fossil-fuel generation in most markets.

Figure 5: Transition Investment Needs to Quadruple by 2050

Annual Energy Transition and Grid Investment, Current vs. Required (Tril. $)

Source: BloombergNEF, “Energy Transition Investment Trends 2024.” Targets set on January 2024.

Strong corporate demand is driving investment in renewable energy projects globally. We expect unprecedented investment in the global buildout of renewable power generation to decarbonize the power sector, the world’s largest source of carbon emissions. Yet an important—and often overlooked—factor is the need to connect all these new clean energy sources to the electricity grid and deliver it to the end consumer. Utilities will need capital to make significant upgrades to replace aging transmission and distribution infrastructure to further support the new renewable generation that is expected to come online over the coming years. Future green energy projects are likely to face resistance until substantial investment is made in expanding and improving power infrastructure globally, as many power grids are now decades old and already operating at capacity.

Given the magnitude of these decarbonization initiatives, we believe that significant opportunities will emerge for investors with scale and expertise in operating clean energy solutions and grid infrastructure. As the renewables sector continues to mature and as regulated utilities evolve and modernize, we expect there will be significant need for private capital. For investors, this suggests ample investment opportunities in high quality cash-flow-generating renewable and utility assets.

Deglobalization

Deglobalization trends have taken hold following the global supply chain disruption during the global pandemic. For example, the trade openness index—which measures the importance of international transactions relative to domestic transactions—has dipped since 2022, a trend that began over a decade ago (see Figure 6). And recent geopolitical events in Europe have highlighted the importance of energy security.

Figure 6: Trade Openness Peaked in 2008

Trade as a % of Global GDP

Source: Kalsing and Millionis (2014); Penn World Tables (9.0).

In the U.S., for example, the Inflation Reduction Act provides an estimated $370 billion of financial incentives over the next decade to ensure national energy security as well as accelerate the transition to a clean energy economy (see Figure 7).

Figure 7: The Inflation Reduction Act Will Help the U.S. Meet Net-Zero Goals

The 2022 legislation includes approximately $370 billion in tax credits and other funding to access energy and climate security in the U.S.

Source: The White House, National Climate Task Force, January 2021.

Geopolitical events have also highlighted the need for natural gas in an energy-security-conscious future. For example, in recent years, some countries in Europe have shifted their imports of natural gas from Russia to the U.S. instead. Investment will be needed in critically located infrastructure for the continued processing, transportation and distribution of this commodity.

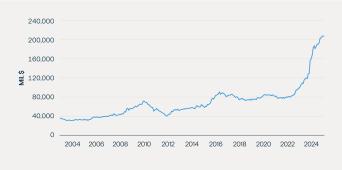

Many countries and companies are also looking to “re-shore” their essential and strategic manufacturing processes and supply chains. For example, the U.S. CHIPS and Science Act provides $280 billion in funding to spur investments in domestic semiconductor manufacturing capacity as well as R&D and commercialization of leading technologies such as AI, quantum computing, clean energy and nanotechnology. The U.S. is expected to triple its domestic chip manufacturing capacity by 2032, the largest increase in the world, according to the Semiconductor Industry Association and Boston Consulting Group. Indeed, total manufacturing construction spending in the U.S. has soared in recent years (see Figure 8). As a result, we see opportunities to provide flexible large-scale capital to onshore the economy’s digital backbone.

Figure 8: U.S. Manufacturing Construction Spending Soars

Total Spending

Source: U.S. Census Bureau, “Total Construction Spending: Manufacturing in the United States,” retrieved from Federal Reserve Bank of St. Louis, May 3, 2024.

Infrastructure Attributes Provide Portfolio Benefits

While there is an immense and growing need for infrastructure investment around the world, the market is only as good as the assets available to invest in. While infrastructure assets can be safe investments due to their high degree of essentiality, that’s not the whole story.

Infrastructure assets can also offer a compelling combination of diversification, downside mitigation, inflation protection, income and long duration for investors. Infrastructure is one of the few asset classes positioned to address near-term factors, such as elevated inflation and interest rate volatility, while offering compelling long-term return potential in part due to the infrastructure supercycle underway.

Diversification

An allocation to private infrastructure has historically increased a portfolio’s return while decreasing risk (see Figure 9).

The diversification benefit stems from private infrastructure’s low correlation to other assets tied more closely to public markets. Infrastructure includes essential services with long-term contracts or government regulation that can include embedded inflation, volume and interest rate protection. These factors shield infrastructure assets from economic and market cycles, and thus returns are largely disconnected from near-term capital market trends.

Figure 9: Private Infrastructure Has Historically Increased a Portfolio’s Overall Return While Decreasing Risk

Risk/Return Spectrum

Source: Bloomberg Global Aggregate Index; Burgiss Global Infrastructure Index; MSCI World Index. For the period January 1, 2013 through June 30, 2023. See endnotes 2 and 5.

Downside mitigation

Infrastructure has historically remained stable during periods of market volatility (see Figure 10). Infrastructure includes assets that provide essential services forming the backbone of local economies in the most developed and highly rated countries.

Because of their essential services and recurring revenue, infrastructure will provide some degree of protection from economic and market risk. However, the degree to which returns are isolated from broader market volatility will ultimately depend on whether cash flows are underpinned by long-term contracts or regulated utility frameworks that remove most exogenous risk factors. The asset’s capital structure will also go a long way to determining how much downside mitigation it provides.

Figure 10: Infrastructure Has Historically Performed Well During Times of Market Uncertainty

Average Quarterly Returns During 10 Worst Quarters for Equity Markets

Source: Bloomberg Global Aggregate Index; Burgiss Global Infrastructure Index; MSCI World Index. For the period January 1, 2013 through June 30, 2023. See endnotes 3 and 5.

Inflation mitigation

Infrastructure has proved to be an effective inflation hedge, and price volatility in recent years has demonstrated the advantage of such inflation mitigation (see Figure 11).

Returns of utilities, for example, are typically regulated and have some form of inflation mitigation and cost pass-through mechanisms. Other types of infrastructure can include single assets that have contractual provisions whereby revenues are indexed to inflation or operating businesses that have dominant market positions and can pass cost increases to customers.

Figure 11: Infrastructure Has Historically Performed as an Effective Inflation Hedge

Average Quarterly Returns During Periods of Above-Average Inflation

Source: Bloomberg Global Aggregate Index; Burgiss Global Infrastructure Index; MSCI World Index. For the period January 1, 2013 through June 30, 2023. See endnotes 4 and 5.

Income

Operating infrastructure assets generally provide predictable long-term cash flows. These can translate to stable yields for investors.

Essential services included in infrastructure often offer protected recurring revenue with inflation indexing as regulated utilities or from long-term take-or-pay contracts.

Long duration

Finally, investing in infrastructure can offer attractive long duration exposure. Assets tend to have a long life and tend to be held for the long term in portfolios. These assets also tend to be financed with long-term fixed rate debt, reducing refinancing risk. One benefit of this is that market timing is less relevant than for other asset classes, so infrastructure assets can ride out the typical ups and downs of the broader market.

Harnessing Infrastructure’s Tailwinds

Both public and private owners of infrastructure have struggled under the weight of balance sheet pressures and financial constraints that have limited their access to capital. These pressures are largely a result of elevated levels of sovereign and corporate debt, still elevated inflation (despite some moderation) and higher-for-longer interest rates. As a result, leverage loan issuance is down 60%, high yield issuance is down 50% and mergers & acquisitions activity is down 70% globally.6

While capital scarcity is a headwind for investments in existing assets and new project development, it is creating a buyer’s market for investors. And combined with strong tailwinds from global long-term trends, infrastructure offers a compelling opportunity for attractive returns and diversification in portfolios.

From an investor’s perspective, infrastructure assets have historically remained stable during periods of market volatility, making infrastructure a compelling asset class for all seasons. Institutional investors have taken note, and infrastructure assets among the nation's top 200 retirement plans were up 212% in the past five years to $72.1 billion, according to Pensions & Investments data as of Sept. 30, 2023. With all the tailwinds in motion, we expect these trends to accelerate over the long term.

While competition for infrastructure assets is increasing globally, managers that remain disciplined in capital deployment—and have the necessary resources, global scale and established sourcing and operational capabilities—should be well positioned to capitalize on attractive infrastructure investment opportunities in the years ahead.

Endnotes:

- Flux Magazine, “Humanity Doubles Its Data Creation Every 18 Months, And It Has Powerful Implications,” Accessed April 4, 2024.

- Past performance is not indicative of future results. For the period January 1, 2013 through June 30, 2023. Source: Bloomberg; Burgiss. Risk is defined as annualized standard deviation. Standard deviation is a commonly-used measure of the risk/reward profile of the risk/reward profile of traditional portfolios and broad market indices. As applied to alternative investment funds and strategies, however, these statistics may materially understate the true risk profile of an alternative investment because alternative investment funds are subject to a loss of principal which is not reflected in the standard deviation of returns, the only measure of risk used in calculating standard deviation. Equities represented by MSCI World Index; Fixed Income represented by the Bloomberg Global Aggregate Index; Private Infrastructure represented by the Burgiss Global Infrastructure Index. There are limitations to the data provided given limited coverage, reporting lag and different valuation methodologies. Further, private infrastructure funds that are included in the index choose to self-report. Thus, the index is not representative of the entire private infrastructure universe and may be skewed towards those funds that generally have higher performance. Over time, funds included and excluded based on performance, may result a “survivorship bias” that can result in a further misrepresentation of performance. The data shown here is presented for general market commentary and is not intended to represent the performance of Brookfield, any of its listed entities or sponsored investment vehicles. See disclosures below for full index definitions.

- Past performance is not indicative of future results. For the period January 1, 2013 through June 30, 2023. Source: Bloomberg; Burgiss. Equities refers to MSCI World Index; Fixed Income refers to the Bloomberg Global Aggregate Index; Private Infrastructure refers to the Burgiss Global Infrastructure Index. The indexes are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative and general market commentary purposes only and does not predict or depict the performance of any investment, including the performance of Brookfield, any of its listed entities or sponsored investment vehicles. See disclosures below for full index definitions.

- Past performance is not indicative of future results. For the period January 1, 2013 through June 30, 2023. Source: Bloomberg; Burgiss. Risk is defined as annualized standard deviation. Equities represented by MSCI World Index; Fixed Income represented by the Bloomberg Global Aggregate Index; Private Infrastructure represented by the Burgiss Global Infrastructure Index. There are limitations to the data provided given limited coverage, reporting lag and different valuation methodologies. Further, private infrastructure funds that are included in the index choose to self-report. Thus, the index is not representative of the entire private infrastructure universe and may be skewed towards those funds that generally have higher performance. Over time, funds included and excluded based on performance, may result a “survivorship bias” that can result in a further misrepresentation of performance. The data shown here is presented for general market commentary and is not intended to represent the performance of Brookfield, any of its listed entities or sponsored investment vehicles. See disclosures below for full index definitions. Inflation is defined as Seasonally Adjusted CPI-U. Periods of Above-Average Inflation are defined as quarters where CPI was above its historical average. During the time period analyzed, average CPI was 2.63% and there were 13 such quarters.

- The Bloomberg Global Aggregate Index is a market-capitalization-weighted index comprising globally traded investment-grade bonds. The index includes government securities, mortgage-backed securities, asset-backed securities and corporate securities to simulate the universe of bonds in the market. The maturities of the bonds in the index are more than one year. The Burgiss Infrastructure Index represents a horizon calculation based on data compiled from infrastructure funds, including fully liquidated partnerships. There are limitations to the Burgiss data provided given limited coverage, reporting lag and different valuation methodologies. Further, private infrastructure funds that are included in the index choose to self-report. Thus, the index is not representative of the entire private infrastructure universe and may be skewed towards those funds that generally have higher performance. Over time, funds included and excluded based on performance, may result a “survivorship bias” that can result in a further misrepresentation of performance. Consumer Price Index (CPI) is a measure of the average change in prices over time in a fixed market basket of goods and services. The MSCI World Index is a free float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets.

- Bloomberg, LevFin Insights and the Federal Reserve for leveraged loan and high yield issuance changes since January 2021. Preqin, M&A decrease calculated based on all deal values in 2022 versus 2023 annualized.

Disclosures

This commentary and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This commentary discusses broad market, industry or sector trends, or other general economic or market conditions. It is not intended to provide an overview of the terms applicable to any products sponsored by Brookfield Asset Management Ltd. and its affiliates (together, “Brookfield”).

This commentary contains information and views as of the date indicated and such information and views are subject to change without notice. Certain of the information provided herein has been prepared based on Brookfield's internal research and certain information is based on various assumptions made by Brookfield, any of which may prove to be incorrect. Brookfield may have not verified (and disclaims any obligation to verify) the accuracy or completeness of any information included herein including information that has been provided by third parties and you cannot rely on Brookfield as having verified such information. The information provided herein reflects Brookfield’s perspectives and beliefs.

Investors should consult with their advisors prior to making an investment in any fund or program, including a Brookfield-sponsored fund or program.

Originally posted July 14, 2021